TikTok on My Mind

Monday, 18 March 2024 10:38

Divergent Opinions in External Articles - The opinions expressed in articles from external sources do not necessarily reflect the views of Renalco SA and are shared for informational purposes only.

The recent tussles over TikTok reflect the deep distrust between the US and China, exacerbated in an election year. Last week, the House of Representatives approved a bill that would force ByteDance to divest TikTok or be banned from US app stores.

Although it received wide bipartisan support in the lower house, the path to the Senate remains unclear as some senators have vowed to fight it (170m Americans are reportedly using TikTok). And even if it does manage to pass the Senate and become law, it is likely to face legal challenges.

The stand-off with TikTok is actually not new. Back in 2020, then-President Trump issued an executive order blocking the app and giving ByteDance 90 days to divest from its American assets and any data that TikTok had collected in the US. At that time, an agreement was formulated with Oracle and Walmart to acquire TikTok’s US operations, but the deal fell apart after Biden came to power and rescinded Trump’s order. So now TikTok is back in the news. Why now? Because taking on China – particularly in an election year – really fires up the voters, and anything that might provide an electoral edge is definitely worth doing.

The issue for investors is not TikTok (ByteDance is not listed). It is rather the noise this fight generates in financial markets. Our longstanding view is that in a US election year, we cannot expect trade tensions to ease between the US and China. However, in early February we were also of the view that after the sharp sell-off of Chinese equities in the preceding quarters, the bar was quite low, which we believed could allow the country to outpace depressed expectations. The MSCI China outperformed global equity markets last month (8.6%) amid a stabilisation of economic conditions and signs of policy stimulus.

We still believe it is worth revisiting EM Asia equities (10% in our asset allocation). But why not China directly? Because there are simply too many unknowns: real estate, growth, governance, geopolitics, and so on. We show in the report that most recent macro releases signal a growth stabilisation/uptick, but not a dramatic turnaround. We believe that confidence regarding China remains low, its growth targets are ambitious but the means to achieve them are unclear, and while the real estate meltdown could be reaching a floor, this is speculative.

Conversely, EM Asia offers the benefits of diversification: Taiwan, Korea, and India are growing fast relative to their income levels. Taiwan and Korea are heavily tech-biased with TSMC and Samsung. And then China is cheaply valued, as expectations are depressed. Concurrently, in developed markets, the bar to meet expectations has been set quite high after the tech-led rally seen since late October last year.

In developed markets, the most recent data releases put renewed upward pressure on bond yields last week. US inflation remains stuck in the 3%+ area and came in a few basis points above consensus expectations. Nonetheless, in our view this is unlikely to alter the Fed’s path towards rate cuts in late Q2 2024. The Fed’s preferred measure of inflation (the PCE price index) stands below 2.5% at present, in what we assume is an area of tolerance compared to the 2% target. Above all, current inflation does not justify rates near 5.5%. At the same time, however, the conditions that might lead central banks to start signalling aggressive rate cuts have not yet been met. In our asset allocation, we stay short on adding to bonds despite our growing appetite for duration after the rise in yields YTD.

The week ahead: The Federal Reserve monetary policy meeting and Powell’s press conference will be the key milestone of the week. We don’t expect the guidance on interest rates (i.e. the dot plot) to be revised up or down. At present the median of FOMC members puts the Fed funds rate at 4.625% by year-end, from 5.375% at present (i.e. 75bps below). The meetings of the Bank of England and especially the Bank of Japan, which may exit negative rates, will also have market implications. In the euro area, the German IFO survey and preliminary PMIs will set the tone on current growth conditions.

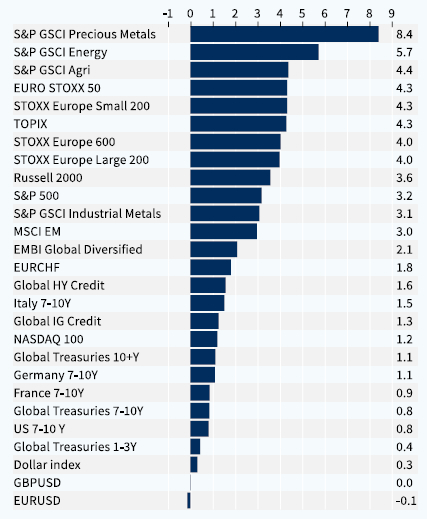

Weekly asset classes performance (%)

Copyright © 2024 Kepler Cheuvreux. All rights reserved.

This document is produced by Kepler Cheuvreux, an investment firm authorized by the ACPR under number 14441 and regulated by the Autorité des Marchés Financiers, incorporated in France under number RCS 413 064 841 at the following address: 112 Avenue Kleber, 75116 Paris, France (www.keplercheuvreux.com).

This document does not constitute a prospectus/regulatory document or other offering document, nor does it constitute an offer or solicitation to purchase securities or other investments. It should not be construed as an offer to sell or a proposal to buy any securities in any jurisdiction in which such an offer or proposal would be unlawful. We are not soliciting any action on the basis of this document, which is provided to our clients for general information purposes. It does not constitute an investment recommendation or a personalized recommendation, and does not take into account the investment objectives, financial situation and needs of each client. Before acting on the contents of this document, we advise you to check whether it is suitable for your particular situation and, if necessary, to seek professional advice.

The figures relating to past performances refer or relate to past periods and are not a reliable indicator of future results.

The accuracy, completeness or timeliness of information from external sources is not guaranteed, although it was obtained from sources reasonably believed to be reliable. Kepler Cheuvreux assumes no responsibility in this regard.

Information provided in this document concerning market data is retrieved from databases at a precise period of time and is subject to variations.