Reset

528 Monday, 9 September 2024 16:09

Divergent Opinions in External Articles - The opinions expressed in articles from external sources do not necessarily reflect the views of Renalco SA and are shared for informational purposes only.

Market conditions have remained volatile since early September, as investors reassess the risk that the US economy ends up experiencing a sharper slowdown than expected. Weak job creation in the past two months has raised fears that domestic consumption, the main engine of growth in the US, eventually hits a wall. This would lead to substantial downward revisions to EPS growth expectations for 2025, which currently stand at 15% YoY for the S&P 500.

This is the third time this year that markets experience a “reset”, and on each occasion it has been a buying opportunity. We will see whether this time is different. In our view, rich valuations involve regular bouts of volatility. But the absence of a US recession should prevent markets from experiencing a deep correction.

In the meantime, troubles in US markets have global reverberations, with European and Japanese equities underperforming the S&P 500 last week. Commodities also experienced a sharp pullback, with the Brent down 10% amid rising OPEC and non-OPEC supply at a time when there are question marks over the demand side of the oil market equation. We show in the report our updated supply / demand estimates for crude oil, which point to a strongly oversupplied market next year.

In such conditions, fixed income has contributed to balance the pullback in equities in global portfolios. A softening of labour market tensions in the US along with falling energy prices will actually facilitate the job of central bankers. Next week, we expect the ECB to cut rates by 25 bps (12 September), while on 18 September, the Fed is due to start its monetary easing cycle, with a 25-bps rate cut as well. USD short term rates experienced a significant pullback lately, in anticipation of such turnaround. In the euro area, bond yields have fallen by a lower magnitude than in the US, on the back of cautious messages from the ECB that continues to fret about price pressures.

In our view, cautious messages from markets always deserve attention and seasonality is typically adverse in September. Hence, we do not advocate for aggressive risk taking. But as the late Paul Samuelson used to say, “the stock market has predicted nine out of the last five recessions”. Data releases up to July do not point to a visible slowdown in household consumption. Job openings stay plentiful, while the layoffs and dismissals rate stays far below uncomfortable levels that would point to a massive rise in unemployment ahead.

In Europe, retail sales point to weaker growth conditions and we downgrade the energy sector in equities. We keep preferring defensive and bond proxy sectors, such as Food and Beverage, Health Care, Utilities.

In fact, we believe that the probability of the goldilocks scenario has increased. Under this scenario, inflation would now revert swiftly to the 2% target, allowing central banks to cut rates aggressively and avoid a recession. Lower interest rates and lower energy prices would help towards supporting purchasing power. We show in the report the performance of the S&P 500 around the beginning of rate-cut cycles, historically. Out of the nine rate-cut cycle episodes that we identify since 1970, the S&P 500 was up double-digits in the next twelve months on six occasions, and down (double-digits as well) on three occasions. In the late 80s and mid-nineties, the S&P 500 was strongly up in the run up to the start of the rate-cut cycle, and it didn’t prevent it to keep moving upwards as the Fed provided monetary support.

Week ahead: the US CPI for August and the ECB meeting will be the key events of the week.

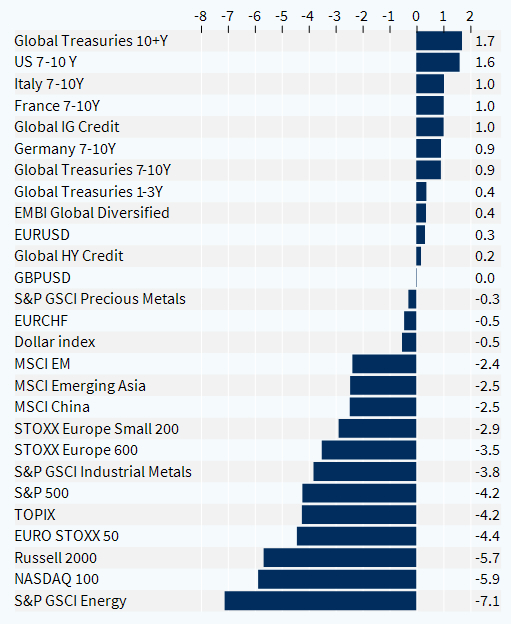

Cross-asset performance (last week, %)

Copyright © 2024 Kepler Cheuvreux. All rights reserved.

This document is produced by Kepler Cheuvreux, an investment firm authorized by the ACPR under number 14441 and regulated by the Autorité des Marchés Financiers, incorporated in France under number RCS 413 064 841 at the following address: 112 Avenue Kleber, 75116 Paris, France (www.keplercheuvreux.com).

This document does not constitute a prospectus/regulatory document or other offering document, nor does it constitute an offer or solicitation to purchase securities or other investments. It should not be construed as an offer to sell or a proposal to buy any securities in any jurisdiction in which such an offer or proposal would be unlawful. We are not soliciting any action on the basis of this document, which is provided to our clients for general information purposes. It does not constitute an investment recommendation or a personalized recommendation, and does not take into account the investment objectives, financial situation and needs of each client. Before acting on the contents of this document, we advise you to check whether it is suitable for your particular situation and, if necessary, to seek professional advice.

The figures relating to past performances refer or relate to past periods and are not a reliable indicator of future results.

The accuracy, completeness or timeliness of information from external sources is not guaranteed, although it was obtained from sources reasonably believed to be reliable. Kepler Cheuvreux assumes no responsibility in this regard.

Information provided in this document concerning market data is retrieved from databases at a precise period of time and is subject to variations.