All ends with beginnings

477 Monday, 16 September 2024 16:46

Divergent Opinions in External Articles - The opinions expressed in articles from external sources do not necessarily reflect the views of Renalco SA and are shared for informational purposes only.

Like the legend of the Phoenix, all ends with beginnings (Get Lucky). After a volatile summer, US equities have regained strength in recent days, pushing global equity markets close to their mid-July highs. All of a sudden, fears have dissipated without any major catalysts, except for additional confirmation that central banks are on track for a new beginning.

In the report this week, we show that the presidential debate between Kamala Harris and Donald Trump was clearly to the advantage of the former, as she challenged Trump’s fitness for office. From an investment perspective, her plan to hike the corporate tax rate is less market friendly than Trump’s programme, in theory. But markets appear to be pricing in the fact that a Democratic sweep is highly unlikely. As a result, such policies are not expected to be implemented. Small caps, which have been tied to Trump’s election probabilities, eventually proved resilient despite the Trump pullback in polls.

On the macro front, rates kept edging lower despite the rebound in risk sentiment and commodity prices. The turnaround in monetary policy is a major driver of rates at present. The 2s10s spread in euros is on the cusp of turning positive after two years in negative territory. Last week, the ECB cut rates by 25bps, for the second time this year, but refrained from turning aggressively dovish. Finding a consensus within the Governing Council remains complex, limiting the ECB’s capability to be ahead of the curve despite weak growth conditions and tougher-than-ever competition with China.

- China was typically an area of concern at our Autumn Conference, which gathered around 200 European companies over three days last week in Paris. In particular, companies depending on Chinese consumption warned of an incrementally weaker picture. But typically, a company like Philips, which sells heavy medical equipment to hospitals, expects local governments to push for more stimulus in the coming months.

In European equities, for some time we have been expressing a preference for defensive sectors, with a particular emphasis on Health Care. This sector benefits from megatrends such as population ageing and rising health care spending. Fighting obesity is a major theme supporting the big Pharma players, with Roche entering the Eli Lilly versus Novo Nordisk competition recently. The Pharma sector also fits the bill on the back its low beta/defensive features amid weak growth conditions in Europe. It is not exposed to Chinese competition and is strongly geared towards the fast-growing US market.

Within Health Care, we focus this week on MedTech. This is typically a growth sector that is sensitive to interest rates, which has been under severe pressure in the rate-hike cycle of the past two and a half years. Recently, it has started to regain momentum. And although we recommend to Overweight the sector, some selectivity is due as some stocks have a significant exposure to China, where visibility remains low (Carl Zeiss Medtiec, Philips, Siemens Healthineers). Still, we believe the sector stands out as one of the rare pockets of structural growth and expertise in European equities (20% earnings growth over the next year).

- We had a strong presence of Medtech companies at our Autumn Conference last week, with ten companies attending (BioMérieux, Carl Zeiss Meditech, Coloplast, Demant, Elekta, GN Store Nord, Philips, Sartorius Stedim, Siemens Healthineers, Straumann). In line with the Q2 reporting season, the messages remained mixed, with China, consumer, destocking, and the macro being the main topics popping up in every discussion. The strongest messages were provided by BioMérieux (Buy), where product launches and initiatives of the GO 28 strategy plan are showing good progress, while perhaps the bleakest message might have come from GN, where there are no signs of a recovery as of yet. Also from Philips (Buy), we got the impression that their confidence to continue delivering was high. The cost base has been adjusted and hence despite a somewhat softer top-line dynamic they were able to deliver healthy margin progress, which “will continue”.

- Most preferred stocks of our Medtech equity research analysts: Fresenius SE, Tecan. Least preferred stocks of our Medtech equity research analysts: Alcon, Diasorin, Sonova.

Week ahead: The FOMC meeting on 18 September will be the key market event of the week. In this report, we explain why we expect the Fed to start its monetary easing cycle on Wednesday with a 25bp rate cut. Still in the US, retail sales will provide preliminary insights into consumer trends in August. In Japan, the BoJ will meet on 20 September and appears unlikely to hike rates, though the message will remain hawkish.

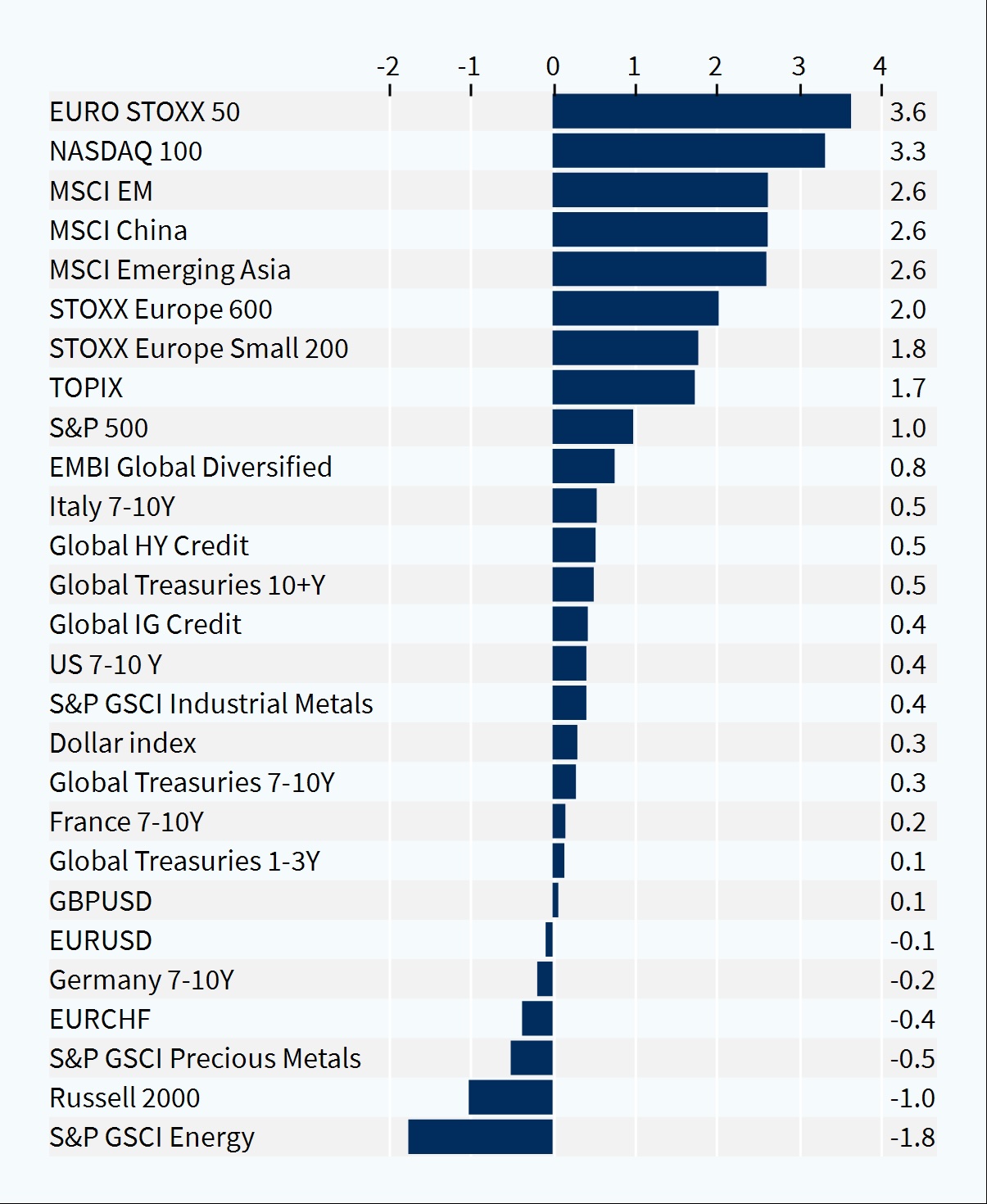

Cross-asset performance (last week, %)

Copyright © 2024 Kepler Cheuvreux. All rights reserved.

This document is produced by Kepler Cheuvreux, an investment firm authorized by the ACPR under number 14441 and regulated by the Autorité des Marchés Financiers, incorporated in France under number RCS 413 064 841 at the following address: 112 Avenue Kleber, 75116 Paris, France (www.keplercheuvreux.com).

This document does not constitute a prospectus/regulatory document or other offering document, nor does it constitute an offer or solicitation to purchase securities or other investments. It should not be construed as an offer to sell or a proposal to buy any securities in any jurisdiction in which such an offer or proposal would be unlawful. We are not soliciting any action on the basis of this document, which is provided to our clients for general information purposes. It does not constitute an investment recommendation or a personalized recommendation, and does not take into account the investment objectives, financial situation and needs of each client. Before acting on the contents of this document, we advise you to check whether it is suitable for your particular situation and, if necessary, to seek professional advice.

The figures relating to past performances refer or relate to past periods and are not a reliable indicator of future results.

The accuracy, completeness or timeliness of information from external sources is not guaranteed, although it was obtained from sources reasonably believed to be reliable. Kepler Cheuvreux assumes no responsibility in this regard.

Information provided in this document concerning market data is retrieved from databases at a precise period of time and is subject to variations.