Middle East reaching boiling point: what are the market implications?

553 Monday, 7 October 2024 12:14

Divergent Opinions in External Articles - The opinions expressed in articles from external sources do not necessarily reflect the views of Renalco SA and are shared for informational purposes only.

With the US presidential election getting closer by the day, tensions in the Middle East are now rising precipitously, which adds another layer of complexity. Over the past two weeks, there has been a significant escalation in the conflict between Israel and Hezbollah, and by extension Iran. Unsurprisingly, market sentiment has turned more cautious. Overall, however, asset prices have yet to register any concrete effects. In the US, the strong job market report for September has also contributed to quelling fears about a recession, causing sector rotations as we speak.

From an investment perspective, commodity prices are the channels of transmission of geopolitical tensions to global markets. The fear that increasing escalation in the Israel-Hezbollah conflict could lead to Iran’s greater involvement and to a potential closure of the Hormuz Strait, the world’s most important oil transit chokepoint, are factors that involve upside risks on oil due to the potential tightening of supply. Iran currently produces 3.4 mb/d of crude oil, of which half is exported (essentially to China). The worst case for investors is thus that oil prices rally and translate into renewed inflation concerns, leading central banks to put their easing bias on hold or even to consider hiking rates again. The resurgence of stagflation risk, a tail risk in our view, would be adverse for both equities and bonds, with commodities and a few thematics (Defence, Energy) the only winners. Also, in a very tight presidential race in the US, any spike in oil prices could shift the balance. Harris would be disadvantaged if purchasing power concerns resurface for voters just as the US enters the final stretch before the election.

So, the key question is whether the probability of escalation/spiking oil prices is high or not. This is obviously a very tough question, and no one has a definitive answer. But in our view, geopolitics generally remain a source of noise in financial markets that can lead to bad investment decisions. The likelihood of further escalation between Iran and Israel appears relatively low to us. Similar tensions between both countries faded rapidly in April. For sure, there could be threshold effects, beyond which the possibility of a major armed conflict erupting in the region could rise considerably.

However, none of the players involved appear to have a real interest in further escalation: Israel would be opening another major front. And Iran probably cannot afford a war economy, with inflation already at around 40% and recurrent civil unrest over the past five years. The late 2022/early 2023 protests in Iran were reported as the most widespread since the 1979 revolution. Nevertheless, the prisoner’s dilemma, a concept in game theory that has been applied to arms races and conflicts, has long established that a conflict can arise even though everyone stands to lose from it.

As long as fundamentals do not point to upside risks on oil prices, and as we believe that trading the fast-changing newsflow can lead to bad outcomes, we stay put and make no changes to our strategic asset allocation. Tactically, it makes sense to reduce bond duration and/or increase long positions on the US dollar. Beyond geopolitics, both trades appear consistent with the strong US labour market as we head into Q4. Our main scenario is that retaliation from both sides will rapidly fade, leading to a fragile new equilibrium in the region. From an equity thematic perspective, the controversial Defence sector continues to make sense. The world order is growing more complex by the day, and the US election has the potential to make it even more so.

In European equities, we revisit the construction cycle and focus on the European Construction Materials sector, which we upgraded on 30 September after the alignment of global monetary pivots (US, EZ, China). There are no longer any reasons to be UW as the bottom of residential markets is in sight. We expect the rebound to be very gradual, notably in Europe. The further drop in policy rates as well as a compression of banks’ margins should help US mortgage rates to continue falling and therefore support housing affordability. It could also help to revive existing home sales. We expect that process to accelerate once the 30Y US mortgage rate drops to around 5% (6.1% today).

Week ahead: US CPI for September and University of Michigan consumer sentiment for October. The Q3 earnings season starts, with financials such as BlackRock, Wells Fargo, BNY, and J.P. Morgan reporting earnings.

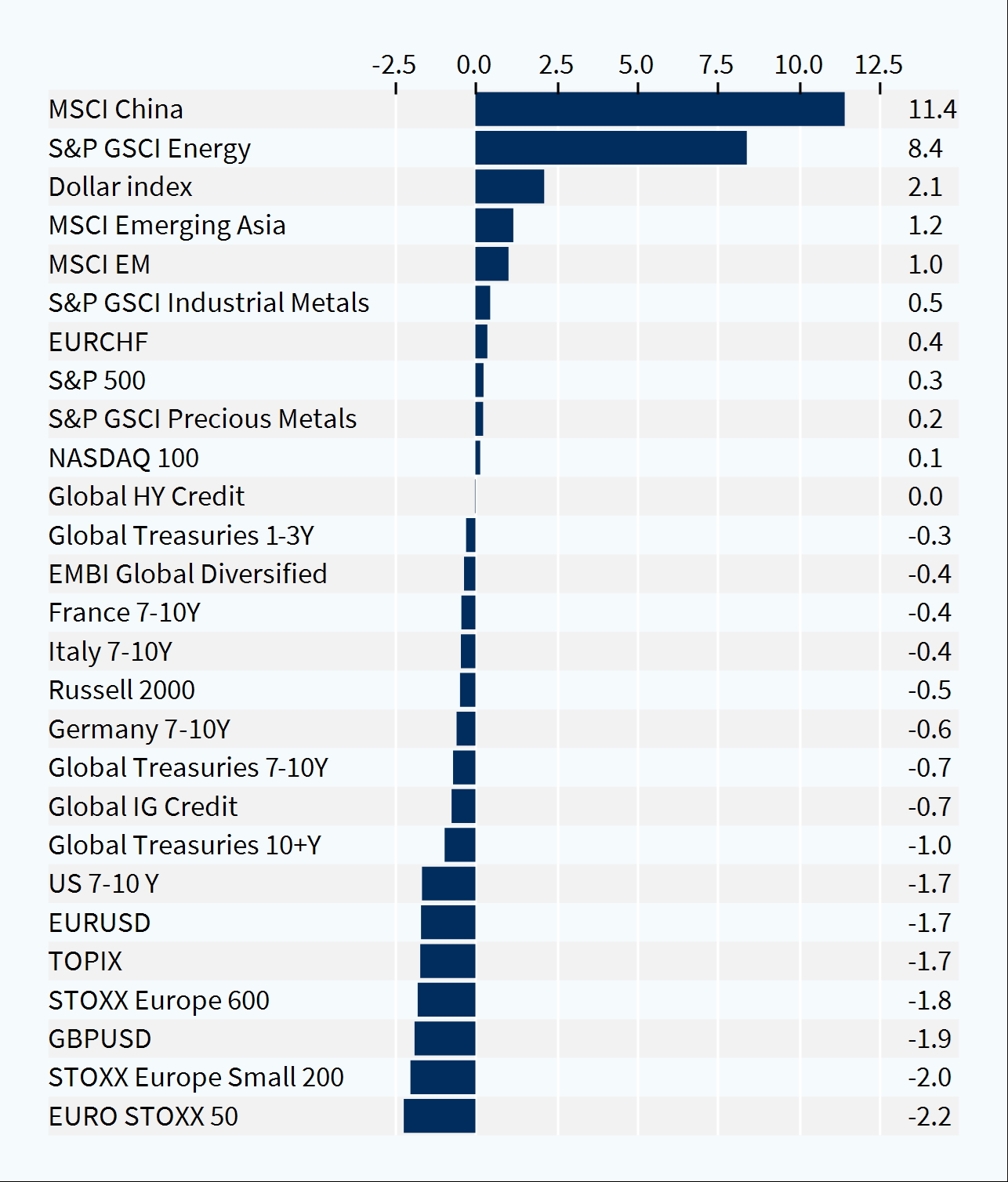

Cross-asset performance (last week, %)

Copyright © 2024 Kepler Cheuvreux. All rights reserved.

This document is produced by Kepler Cheuvreux, an investment firm authorized by the ACPR under number 14441 and regulated by the Autorité des Marchés Financiers, incorporated in France under number RCS 413 064 841 at the following address: 112 Avenue Kleber, 75116 Paris, France (www.keplercheuvreux.com).

This document does not constitute a prospectus/regulatory document or other offering document, nor does it constitute an offer or solicitation to purchase securities or other investments. It should not be construed as an offer to sell or a proposal to buy any securities in any jurisdiction in which such an offer or proposal would be unlawful. We are not soliciting any action on the basis of this document, which is provided to our clients for general information purposes. It does not constitute an investment recommendation or a personalized recommendation, and does not take into account the investment objectives, financial situation and needs of each client. Before acting on the contents of this document, we advise you to check whether it is suitable for your particular situation and, if necessary, to seek professional advice.

The figures relating to past performances refer or relate to past periods and are not a reliable indicator of future results.

The accuracy, completeness or timeliness of information from external sources is not guaranteed, although it was obtained from sources reasonably believed to be reliable. Kepler Cheuvreux assumes no responsibility in this regard.

Information provided in this document concerning market data is retrieved from databases at a precise period of time and is subject to variations.