Owls, really?

Monday, 22 January 2024 15:18

Divergent Opinions in External Articles - The opinions expressed in articles from external sources do not necessarily reflect the views of Renalco SA and are shared for informational purposes only.

Christine Lagarde had a difficult start. Our Italian friends all remember her gaffe on spreads. Back then, she described herself as willing to be an “owl” rather than a hawk or a dove, as an owl is “associated with a little bit of wisdom”.

The Fed and the ECB seem to have behaved pretty “wisely” indeed, having done a good job in helping disinflationary forces grow stronger in the last few quarters. However, the future will tell if they are still acting wisely. For sure, the Fed seems to be trying and we fully appreciate this helps investor sentiment toward risk assets. We have more doubts as regards the ECB.

In the case of the Fed – which surprised us in December – its idea that the growth mandate should be getting back on its radar makes sense if – like us – one is concerned that a lot of factors behind US resilience will gradually disappear, while maintaining very restrictive rates for too long could kill the economy. And its message makes all the more sense if the Fed for once intends to cut rates gradually rather than cut them a lot and very fast.

Yet the surprise announcement from the Fed in December surely triggered some excessive enthusiasm against which central bankers have had to push back lately. Despite a rather mild pushback, we note that the long end of the yield curve has actually come back to pre-Fed meeting levels, while short-term rates have retained some very tiny benefits from the Fed’s communication.

YTD, the move in long-term yields looks big because end-December saw peak optimism of all sorts. All in all, it’s as if Powell’s communication had only benefitted equities decisively. Does that make sense? Yes, it does, since the Fed told us it is starting to care about growth again. But interestingly, while in the US real rates have come down with inflation breakeven going up slightly, a similar trend hasn’t been seen in Europe, suggesting the ECB might be pushing back too hard despite rising recession risks.

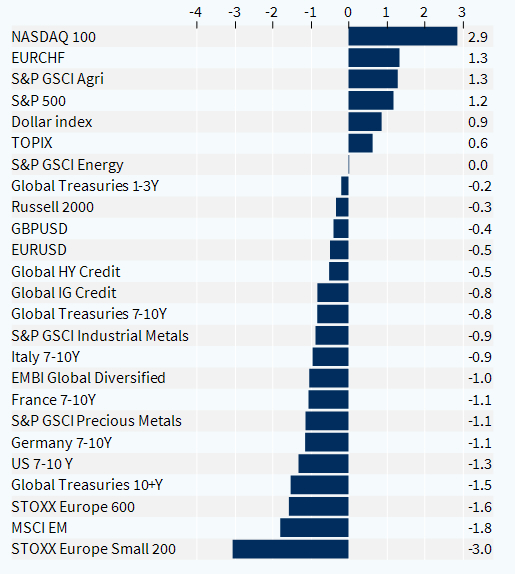

On top of this, the latest data on the US consumer has continued to indicate some strength, fuelling the “no landing” hope. The rally of the Magnificent 7 has thus continued to inflict a 5% performance gap versus the Stoxx 600 in dollars YTD. The European stock market is facing its own headwinds for its sector heavyweights: Oil & Gas stocks have been pressured by lower energy prices, while Basic Resources and Luxury stocks have been pressured by weakening Chinese growth.

In fact, today we downgrade the Utilities sector to Neutral (from OW), acknowledging the sharp fall in power price futures and the more structural nature of that dynamic with ample supplies of gas. It’s a Neutral rating, not UW. Utilities continue to pay nice dividends and the growth part of the sector has tumbled already. We prefer Telecoms among the “Defensive Value” sectors. Note that this power price development is extremely welcome for European real growth in 2025.

In the short term, a decent US earnings season might push equities higher. But in the background, we would expect the Fed to keep fighting back against rising inflation breakeven. Overall, the near term upside on benchmark indices appears limited and we find more value in bonds assuming the US economy will decelerate over the course of H1-2024.

Weekly asset classes performance (%)

Copyright © 2024 Kepler Cheuvreux. All rights reserved.

This document is produced by Kepler Cheuvreux, an investment firm authorized by the ACPR under number 14441 and regulated by the Autorité des Marchés Financiers, incorporated in France under number RCS 413 064 841 at the following address: 112 Avenue Kleber, 75116 Paris, France (www.keplercheuvreux.com).

This document does not constitute a prospectus/regulatory document or other offering document, nor does it constitute an offer or solicitation to purchase securities or other investments. It should not be construed as an offer to sell or a proposal to buy any securities in any jurisdiction in which such an offer or proposal would be unlawful. We are not soliciting any action on the basis of this document, which is provided to our clients for general information purposes. It does not constitute an investment recommendation or a personalized recommendation, and does not take into account the investment objectives, financial situation and needs of each client. Before acting on the contents of this document, we advise you to check whether it is suitable for your particular situation and, if necessary, to seek professional advice.

The figures relating to past performances refer or relate to past periods and are not a reliable indicator of future results.

The accuracy, completeness or timeliness of information from external sources is not guaranteed, although it was obtained from sources reasonably believed to be reliable. Kepler Cheuvreux assumes no responsibility in this regard.

Information provided in this document concerning market data is retrieved from databases at a precise period of time and is subject to variations.