Is it now time to pivot?

Monday, 26 February 2024 13:08

Divergent Opinions in External Articles - The opinions expressed in articles from external sources do not necessarily reflect the views of Renalco SA and are shared for informational purposes only.

The earnings season will soon come to an end in the US, with 90% of companies having reported earnings. It was another robust earnings season, with strong surprises versus earnings and margins expectations.

Yet, the investment landscape is not an easy one for risk takers (AKA there is no free lunch!). As of 23 February, the S&P 500 was almost up by 7%, which is close to the average full-year performance of the past five decades. Unless you expect 2024 to be like 2023 (S&P 500 +25%, Nasdaq 100 +54%), you should be thinking about taking some profits. Indeed, the big difference is that the S&P 500 now trades at 21x forward earnings versus 17x at the beginning of last year. In the report, we explore avenues to diversify portfolios.

In Europe, the earnings season is just at the halfway stage, and aggregate earnings surprises have also been positive. Yet, the weaker macro backdrop, tight monetary conditions, and higher sensitivity to China all contribute to explaining why sentiment remains mixed towards European stocks. There is also a huge performance discrepancy between broad regional benchmarks such as the STOXX Europe 600 (+3.8% YTD) and the EURO STOXX 50 (7.8% YTD). Part of the difference can be attributed to currency effects (STOXX Europe 600 hedged euro is up by 4.1%), and part also to the underperformance of the UK and Switzerland, which represent more than 35% of the STOXX Europe 600. In addition, the divergence between both benchmarks also reflects the outperformance of large caps versus small caps.

- The YTD underperformance of small caps versus large caps is all the more surprising given that the macro backdrop has been better than expected. With small caps being more sensitive to the economic cycle than large caps, they should have outperformed, following several positive economic surprises in recent months both in Europe and in the US. But while cyclical sectors did outperform defensive sectors, small caps lagged behind on both sides of the Atlantic. We show in the report that small caps have suffered from an unusually high sensitivity to interest rates, which could soon become a tailwind as we expect the rerating of interest rate expectations to be largely done.

Diversify your portfolio. Just to put things into context, I have a colleague at the office who keeps asking me why I bother with asset allocation and diversification. You just buy Nvidia and that’s it. But I have another colleague, older and with skin in the game, who keeps asking me whether he should sell his Tech funds! As suggested above, we are not at ease with the current valuation of the US equity market. Some investors appear to expect a repeat of 2023, which may lead to disappointment. Other investors think the current market situation is akin to the exuberance that precursored the Tech crash in the early 00s, which we believe is too pessimistic. Nvidia’s quarterly earnings are actually up by 486% over one year!

In this context, we have recently been reshuffling our model portfolio along three lines: first, we reweighted Japanese equities several weeks ago to leverage the JPY weakness/dovish BoJ. Second, we reweighted US high-yield credit to leverage better-than-expected economic prospects and manage the bond portfolio duration. Third, we reinforced the bias towards China, whether through a broad EM Asia equity exposure, which encompasses India, or through European luxury stocks that we upgraded to Overweight. China is not an easy play, having disappointed repeatedly. However, there has been a stabilisation of economic conditions, while the increasing willingness of the authorities to intervene in order to instil confidence may bear some fruit amid low investor expectations. Then, in the coming weeks, we aim to extend the bond duration of our portfolio because, as we mentioned, we believe the rerating of interest rate expectations is now largely complete. That would be a strong positive for small caps. But timing matters, and we would probably need more signs of a growth slowdown in the US before we would consider piling into long-dated Treasuries. Nonetheless, yields for govies and credit markets are high, and sufficiently attractive for long-term investors to leave aside the matter of timing and lock in current interest rates for the coming years.

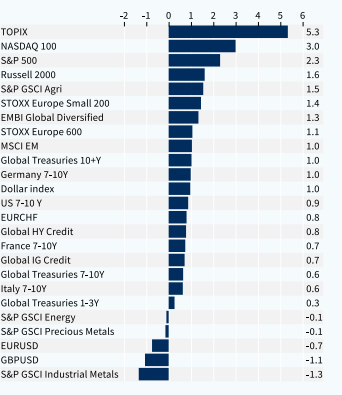

Weekly asset classes performance (%)

Copyright © 2024 Kepler Cheuvreux. All rights reserved.

This document is produced by Kepler Cheuvreux, an investment firm authorized by the ACPR under number 14441 and regulated by the Autorité des Marchés Financiers, incorporated in France under number RCS 413 064 841 at the following address: 112 Avenue Kleber, 75116 Paris, France (www.keplercheuvreux.com).

This document does not constitute a prospectus/regulatory document or other offering document, nor does it constitute an offer or solicitation to purchase securities or other investments. It should not be construed as an offer to sell or a proposal to buy any securities in any jurisdiction in which such an offer or proposal would be unlawful. We are not soliciting any action on the basis of this document, which is provided to our clients for general information purposes. It does not constitute an investment recommendation or a personalized recommendation, and does not take into account the investment objectives, financial situation and needs of each client. Before acting on the contents of this document, we advise you to check whether it is suitable for your particular situation and, if necessary, to seek professional advice.

The figures relating to past performances refer or relate to past periods and are not a reliable indicator of future results.

The accuracy, completeness or timeliness of information from external sources is not guaranteed, although it was obtained from sources reasonably believed to be reliable. Kepler Cheuvreux assumes no responsibility in this regard.

Information provided in this document concerning market data is retrieved from databases at a precise period of time and is subject to variations.