Hung parliament, but not quite as expected

Monday, 8 July 2024 14:17

Divergent Opinions in External Articles - The opinions expressed in articles from external sources do not necessarily reflect the views of Renalco SA and are shared for informational purposes only.

Macron has managed to contain Marine Le Pen’s far-right party from taking the helm of France. While after the first round a week ago, it seemed this scenario was inevitable, the republican front formed by the centrists and left bloc has proven very successful.

Nonetheless, the outcome is very different from the various polls of last week since the left alliance (NFP) won many more seats than expected to the detriment of the far right (RN).

- The great winner of the election is still the RN (+37 seats), but the Socialists (+33 seats) and the Ecologists (+10 seats) of the left alliance made higher gains, cumulatively. The great losers are the centrists, with Macron’s party (Renaissance) losing 70 seats, and the center-right (Les Republicains, -17 seats that have joined the RN). Macron’s Renaissance party remains nonetheless the second largest single party in the new parliament (102 seats), behind the RN (126 seats).

Politically speaking, a period of uncertainty now begins as parties attempt to build a politically sustainable coalition. The positives of the outcome in our view: pro EU parties dominate the assembly, the combination of far right and far left don’t have an absolute majority and the progress of the left alliance is essentially driven by the more moderate socialists. On the negative side, the market might not like the likely leftist compromises that might take place. Overall though, as anticipated by polls, the parliament is in a grid-lock and some compromises will need to emerge in the coming weeks. In our view, markets should thus keep a cool head pending more clarification after a slightly lower opening.

- Technically speaking, Macron has the exclusive prerogative to appoint the Prime Minister and he is not subject to any deadline to do so (Article 8 of the Constitution). The only constraint to this nomination is that Article 49 allows the Assembly to overthrow the government by tabling a motion of censure. Hence the President has to choose the candidate of the majority camp, otherwise it will be immediately overthrown. In the current configuration, since there is no majority, Macron will have to pick a candidate that maximizes the chances of gathering a majority.

Outside of France, the world keeps turning. In particular, the Tories were trounced in the UK elections, as forecast. We have not commented much on the UK election as it became clear in the early stages of the campaign that a Labour victory under Keir Starmer would not disrupt the financial markets. In fact, we note that the GBP reacted well to the outcome. Starmer’s ambitious plan for new housing is a straightforward solution to ease purchasing power pressures, a card Macron didn’t play.

On the other side of the Atlantic, the odds of a Biden victory have plummeted, prompting Democrats to consider another candidate. The very short timeframe until the 19-22 August Democratic National Convention are seriously limiting the available options to derail Trump’s momentum in election polls.

Bullish bonds. On the macro front, US payroll data added to a series of data points showing a slowdown in motion. Another good US CPI data point (June CPI to be released on Thursday) would increase the odds of additional rates cuts in the next 12 months. That would prove supportive for curve steepening trades.

Implications on equities. With the expectation that US 10Y yields will keep sliding (our technical analysis expert argues a break of 4.15% downwards would accelerate the decline to 3.80/3.50), we reiterate our positive stance on key bond proxies: Real Estate, Household and Personal Care, Business Services, and Med-Techs. We are neutral on Utilities, the second most inversely correlated sector to US 10Y rates.

- Turning to sectors that are positively correlated to bond yields, we are neutral on Banks and Insurance and believe these sectors should continue to consolidate. However, with the geopolitical context still very delicate, we keep our OW on Oil & Gas and Basic Resources.

Week ahead: US CPI for June will be the key macro release of the week. The consensus expects inflation at 3.1%, from 3.3% in May. The core CPI is expected to stay unchanged, at 3.4%. In China, the June CPI / PPI is expected to stray weak. On the corporate earnings front, major US banks will start to report towards the end of the week.

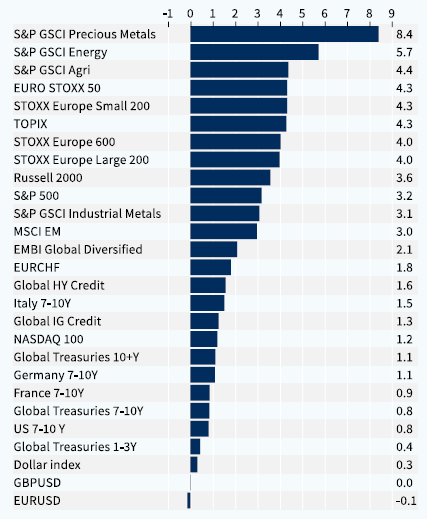

Asset classes performance - weekly (%)

Copyright © 2024 Kepler Cheuvreux. All rights reserved.

This document is produced by Kepler Cheuvreux, an investment firm authorized by the ACPR under number 14441 and regulated by the Autorité des Marchés Financiers, incorporated in France under number RCS 413 064 841 at the following address: 112 Avenue Kleber, 75116 Paris, France (www.keplercheuvreux.com).

This document does not constitute a prospectus/regulatory document or other offering document, nor does it constitute an offer or solicitation to purchase securities or other investments. It should not be construed as an offer to sell or a proposal to buy any securities in any jurisdiction in which such an offer or proposal would be unlawful. We are not soliciting any action on the basis of this document, which is provided to our clients for general information purposes. It does not constitute an investment recommendation or a personalized recommendation, and does not take into account the investment objectives, financial situation and needs of each client. Before acting on the contents of this document, we advise you to check whether it is suitable for your particular situation and, if necessary, to seek professional advice.

The figures relating to past performances refer or relate to past periods and are not a reliable indicator of future results.

The accuracy, completeness or timeliness of information from external sources is not guaranteed, although it was obtained from sources reasonably believed to be reliable. Kepler Cheuvreux assumes no responsibility in this regard.

Information provided in this document concerning market data is retrieved from databases at a precise period of time and is subject to variations.