European elections: finding the right balance

Wednesday, 3 April 2024 12:29

Divergent Opinions in External Articles - The opinions expressed in articles from external sources do not necessarily reflect the views of Renalco SA and are shared for informational purposes only.

Amid a relatively quiet macro newsflow, we dig into the upcoming European Parliament elections. This is probably not the most exciting market event of 2024, but the stakes are high, considering the geopolitical context and the generational challenge of energy transition.

In this weekly report, we disentangle the potential market implications of this major democratic event in the world, with over 400m eligible voters across 27 countries. Climate legislation is a very hot topic, and as a European Commissioner recently stated, ideology and pragmatism need to find the right balance, hence the title of this report.

European elections will take place in two months, from 6 to 9 June across the EU member countries to elect the 720 deputies that sit in Strasbourg. Historically, these elections have struggled to engage citizens, with European issues often being poorly understood or perceived as too distant from voters’ daily lives. However, the approaching elections are the first to unfold in a climate of war amid an arms race, and this has the potential to maintain the momentum seen in 2019 in terms of voter participation. Meanwhile, the rise of the populists and the far right could offer significant surprises. Polls indeed indicate that the two Eurosceptic groups, the European Conservatives and Reformists (ECR) and Identity and Democracy (ID), could win between 160 and 180 seats, over 20% of the votes, for the first time. Nevertheless, they remain fragmented, which reduces their potential influence.

With regard to market implications, we put together two trade ideas in the report, which sit at the heart of the next EU legislature: security & defence on the one hand; and renewable energy on the other hand. These two ideas are in opposition to the extent that security & defence is controversial, non-ESG, but benefits from strong momentum in equity markets. In turn, renewables are an important pillar of ESG portfolios, and have positive externalities, but they have massively underperformed in equity markets over the last couple of years.

The momentum trade: security & defence. The theme of security & defence is tightly correlated with the challenging geopolitical conditions, particularly in Europe with the Ukraine/Russia war causing major long-term concerns. As of end-Q1 2024, if anything, the conflict appears to have intensified. An arms race is underway, and Germany is waking up after years of complacency. Furthermore, the American security umbrella could be seriously weakened in the event Trump is re-elected, as polls suggest. Military spending in the EU has increased from less than EUR150bn in 2013 to a record EUR270bn in 2023. Yet, this still falls short of the NATO guideline to spend 2% of GDP and is a considerable way off the USD860bn spent by the US last year. In this context, European defence stocks have risen exponentially. The MSCI Europe Aerospace and Defence is up in excess of 50% over the past twelve months (before dividends). Individual stocks such as Leonardo, Rheinmetall, and Kongsberg are up in the range of 70% to 110% during the same period. The valuation of the sector is indeed elevated, at 22x forward earnings versus an average of 16x, but we cannot say it is excessively valued considering the new geopolitical paradigm. We thus remain constructive on the sector, and our analyst has a Buy rating on Thales, Rolls-Royce Holdings, QinetiQ, and Dassault Aviation, among others.

Furthermore, with regard to the controversial aspect of security & defence, policy makers across Europe and the globe are currently advocating for a step-up in defence capabilities. In our view, investing in defence should not be controversial today. Like the Latin adage that originated in Vegetius’s fifth century Treatise on Military Affairs: “If you want peace, prepare for war”.

The value trade: renewable energy. In stark contrast to the defence sector, the renewable energy theme is much less controversial. But it is also much more challenged in equity markets. A benchmark of renewable energy producers is down by 48% since the summer of 2022. The bubbly valuation of renewable stocks has largely normalised, to the point that what was assimilated into the “growth” style in the past has become “value”. Unsurprisingly, interest in the theme has vanished. Yet, investment plans in clean energy are huge, estimated at USD1.7trn globally in 2023 (60% of global energy investment). According to the IEA, clean energy investment must reach USD4.5trn per year by 2030 to limit global warming to 1.5°C. From a market standpoint, there is a major question mark with regard to the return on investment, and our analysts recently highlighted the correlation between large investment plans and the valuation discount (link). This is also consistent with the huge sensitivity of renewable stocks to interest rates. From that perspective, we believe that renewables are appealing on the theme of falling bond yields. In addition, the newsflow around European elections could spark renewed interest in the theme. We recently upgraded Orsted (Buy), we added renewable power giant EDPR to our European Large Caps Selected List, and we rate most renewable pure players at Buy (Neoen, Voltalia, Iberdrola). Our analysts also like network companies such as E.ON, Redeia, and Elia.

On the macro front, we increase our exposure to gold. Purchases from the PBOC are a key structural tailwind while reserve assets such as gold benefit from the perceived inconsistency between “sticky inflation” and “rate cuts”. Gold miners are a leveraged play on gold, which are reasonably valued. We still expect four Fed rate cuts this year and see no inconsistency considering the latest PCE price index release, at 2.5% YOY. This is the Fed’s preferred measure of inflation and although it is above the 2% target and somewhat sticky at that level, we consider the current rate regime to be fit for a 5-6% inflation rate, not 2.5-3%, hence the expected rate cuts that will start in June, in our view.

Week ahead: The macro agenda will be back at the forefront, with the US job market report for March available on Friday.

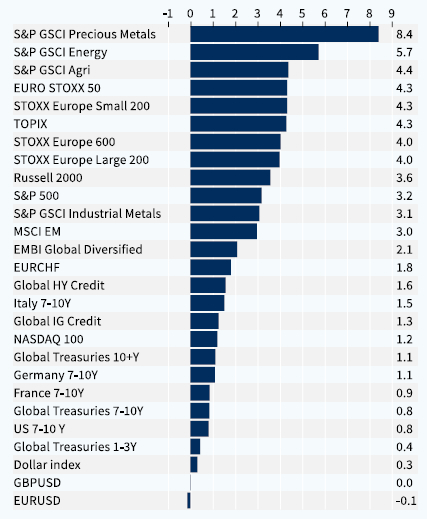

Weekly asset classes performance (%)

Copyright © 2024 Kepler Cheuvreux. All rights reserved.

This document is produced by Kepler Cheuvreux, an investment firm authorized by the ACPR under number 14441 and regulated by the Autorité des Marchés Financiers, incorporated in France under number RCS 413 064 841 at the following address: 112 Avenue Kleber, 75116 Paris, France (www.keplercheuvreux.com).

This document does not constitute a prospectus/regulatory document or other offering document, nor does it constitute an offer or solicitation to purchase securities or other investments. It should not be construed as an offer to sell or a proposal to buy any securities in any jurisdiction in which such an offer or proposal would be unlawful. We are not soliciting any action on the basis of this document, which is provided to our clients for general information purposes. It does not constitute an investment recommendation or a personalized recommendation, and does not take into account the investment objectives, financial situation and needs of each client. Before acting on the contents of this document, we advise you to check whether it is suitable for your particular situation and, if necessary, to seek professional advice.

The figures relating to past performances refer or relate to past periods and are not a reliable indicator of future results.

The accuracy, completeness or timeliness of information from external sources is not guaranteed, although it was obtained from sources reasonably believed to be reliable. Kepler Cheuvreux assumes no responsibility in this regard.

Information provided in this document concerning market data is retrieved from databases at a precise period of time and is subject to variations.