Alea Jacta Est

Monday, 1 July 2024 13:34

Divergent Opinions in External Articles - The opinions expressed in articles from external sources do not necessarily reflect the views of Renalco SA and are shared for informational purposes only.

What is going on in French politics? After heated political debates on this side of the Atlantic as well, the first round of the French legislative election confirmed the rise of the far-right (33.1%) in a context of high turn-out (67.5%). The specificities of these elections (2nd round next Sunday with a record number of three-way runoffs) still leave many options open. We expect to have more clarity from Wednesday once second round candidates will have been confirmed.

Markets found reassurances on the small probability that the far-right gets an absolute majority in the French Parliament. At the open on Monday, French banks rebounded, the OAT/ Bund spread tightened and the EURUSD appreciated. Although uncertainty is likely to persist in the next few days, the first round of the legislative election did not bring negative surprises compared to election polls. Importantly, it was not a bloodbath for pro-EU moderate political parties. Our probability-weighted analysis suggests the small rebound on French assets should continue. In any case, the two extreme parties will likely need to compose with the center to form a majority. Yet, a strong relative majority for the far-right would still lead to a complex political equation in France in the next few years.

Diversify France. From a global market perspective, the French-related political uncertainty remains a local factor that can be easily diversified. The implications on asset prices have been regional, not global. The Spanish and Italian sovereign widened further last week (+5 bps vs. swaps). But apart from that, markets have not expressed signs of major concern ahead of the first round of the French election. Japanese equities (OW) kept rallying as the Yen reached multi-decade lows vs. USD. In Europe, we keep preferring the Swiss and UK market, with currency exposure versus Euro.

Bullish bonds. We find that economic surprises are collapsing in the US, but short dated yields remain under the control of the Fed, which has maintained a wait and see approach with regards to rate cuts so far. Next week, the US job market report will contribute to clarify the picture. We expect the upcoming numbers to confirm the disinflation picture and increase the likelihood that the Fed will start cutting rates by September. Investors show rising appetite for bond duration, with impressive inflows into long dated Treasuries (TLT US ETF).

Get ready for the earnings season. Ahead of the start of the earnings season, we revisit consensus expectations. In Europe, earnings growth expectations for 2024 have been revised slightly down YTD, while those for 2025 have been revised upwards (but primarily due to a base effect vs 2024). In the US however, analysts have continued to revise up earnings growth estimates for 2025 (2024 is flat). Sector-wise, Luxury Goods and Autos could see further negative revisions, while consensus expectations for Banks look fair according to our analysts. Chemicals still lack visibility for the second half.

Week ahead. On top of the June job market report in the US, the ISM survey will shed light on recent economic dynamics. In the euro area, the June CPI will be particularly important ahead of the 18/07 ECB meeting. The ECB has started to cut rates but has signalled a back-to-back rate cut was unlikely.

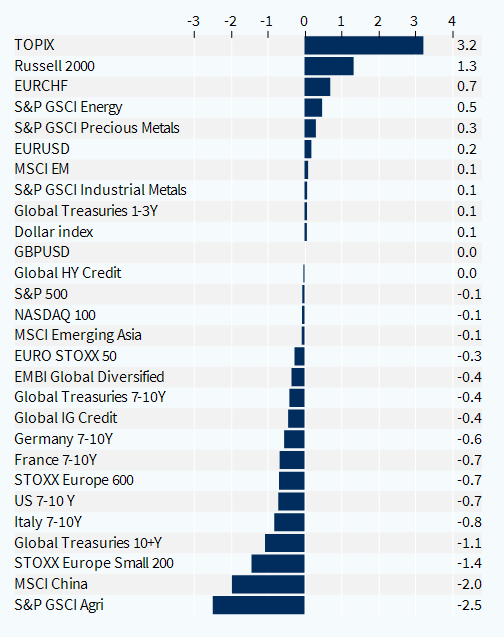

Asset classes performance - weekly (%)

Copyright © 2024 Kepler Cheuvreux. All rights reserved.

This document is produced by Kepler Cheuvreux, an investment firm authorized by the ACPR under number 14441 and regulated by the Autorité des Marchés Financiers, incorporated in France under number RCS 413 064 841 at the following address: 112 Avenue Kleber, 75116 Paris, France (www.keplercheuvreux.com).

This document does not constitute a prospectus/regulatory document or other offering document, nor does it constitute an offer or solicitation to purchase securities or other investments. It should not be construed as an offer to sell or a proposal to buy any securities in any jurisdiction in which such an offer or proposal would be unlawful. We are not soliciting any action on the basis of this document, which is provided to our clients for general information purposes. It does not constitute an investment recommendation or a personalized recommendation, and does not take into account the investment objectives, financial situation and needs of each client. Before acting on the contents of this document, we advise you to check whether it is suitable for your particular situation and, if necessary, to seek professional advice.

The figures relating to past performances refer or relate to past periods and are not a reliable indicator of future results.

The accuracy, completeness or timeliness of information from external sources is not guaranteed, although it was obtained from sources reasonably believed to be reliable. Kepler Cheuvreux assumes no responsibility in this regard.

Information provided in this document concerning market data is retrieved from databases at a precise period of time and is subject to variations.