What can “stop this train”?

Monday, 12 February 2024 11:53

Divergent Opinions in External Articles - The opinions expressed in articles from external sources do not necessarily reflect the views of Renalco SA and are shared for informational purposes only.

The US guitarist John Mayer has a great song called “Stop this train” singing “I can’t take the speed it’s moving in”. That must sound familiar!

In today’s weekly, we thus ask ourselves what can stop this (US) long train running, led by the Magnificent 7. We also make two significant European sector adjustments (Luxury up, banks down).

US bull run: what’s driving it?

- AI: this is the key driver for a number of investors, who are saying: “Get me in”. This theme actually has a number of sub-drivers: booming earnings growth from Big Techs, driven by good costs control, advertising monetisation, and cloud growth. Hope: Hyper scalers announced massive investments in new infrastructures, which backs the idea that some big new applications are coming. Macro: a strong US consumer with no evidence of an imminent reversal.

- The Fed’s put is back in play: Despite the timing pushback, the Fed is also saying “Count on us to cut if the labour market worsens”. However, the more markets go up, the more the put is out of the money.

- Low diversification incentives reflected in the rising dollar: The strong US economy is supporting the dollar, and it has reduced the incentive to diversify away for global investors; at the same time, the eurozone economy remains stagnant, while China’s economic momentum continues to worry.

What can challenge that trend?

- Commercial real estate remains a hot topic considering the large exposure of small and mid sized banks. Default rates remain low but are rising fast.

- US economy running too hot/ oil prices jumping, forcing the Fed to make a U-turn on its December pivot; or conversely, some confirmation that the long-awaited “soft landing” is coming.

- US elections: uncertainty about the US elections could weigh on markets as Trump is unpredictable/ Biden too old.

- Price action: valuations are rich and an extreme level in the Nasdaq 100 could in itself trigger some profit taking. The technical configuration suggests March could favour profit taking.

Moving on to our MSCI Europe sector ratings, we downgrade Banks to Neutral.

- The earnings season has been very polarised with some car crashes on some of the large-cap stocks (BNP, ING) that were less subject to the risk of the “Net interest margin peak” theme. The theme of commercial real estate also weighs in the background even if European banks’ exposure seems limited.

- Later in the year with the prospects of an improving macro in Europe, we might see the sector outperforming again. Although we see some reasons for hope in the consumer driven recovery in Europe, the short term remains very fragile with very tight financial conditions.

- Strong shareholder returns and no signs of an imminent European macro collapse definitely limit the downside from here, hence our Neutral (and not UW).

We upgrade Luxury to OW.

- The fundamental backdrop is that the Luxury sector creates value over time and is a big earnings compounder. It’s also a European specific savoir-faire with no real competition, which makes it a structural buy.

- While it’s early days to be sure that margins don’t have more downside than currently expected, we note that analysts have turned very cautious about H1, implying a window for stocks to ignore some bad news. And indeed, the sector has started to react positively to bad news, which is usually a sign of valuation trough.

With wealth effects still working at full steam in the US, the sector could also welcome more significant pro-growth measures in China. In addition, we suspect that many investors won’t be able to buy China equities directly, and the luxury sector could be an obvious levered play on that theme.

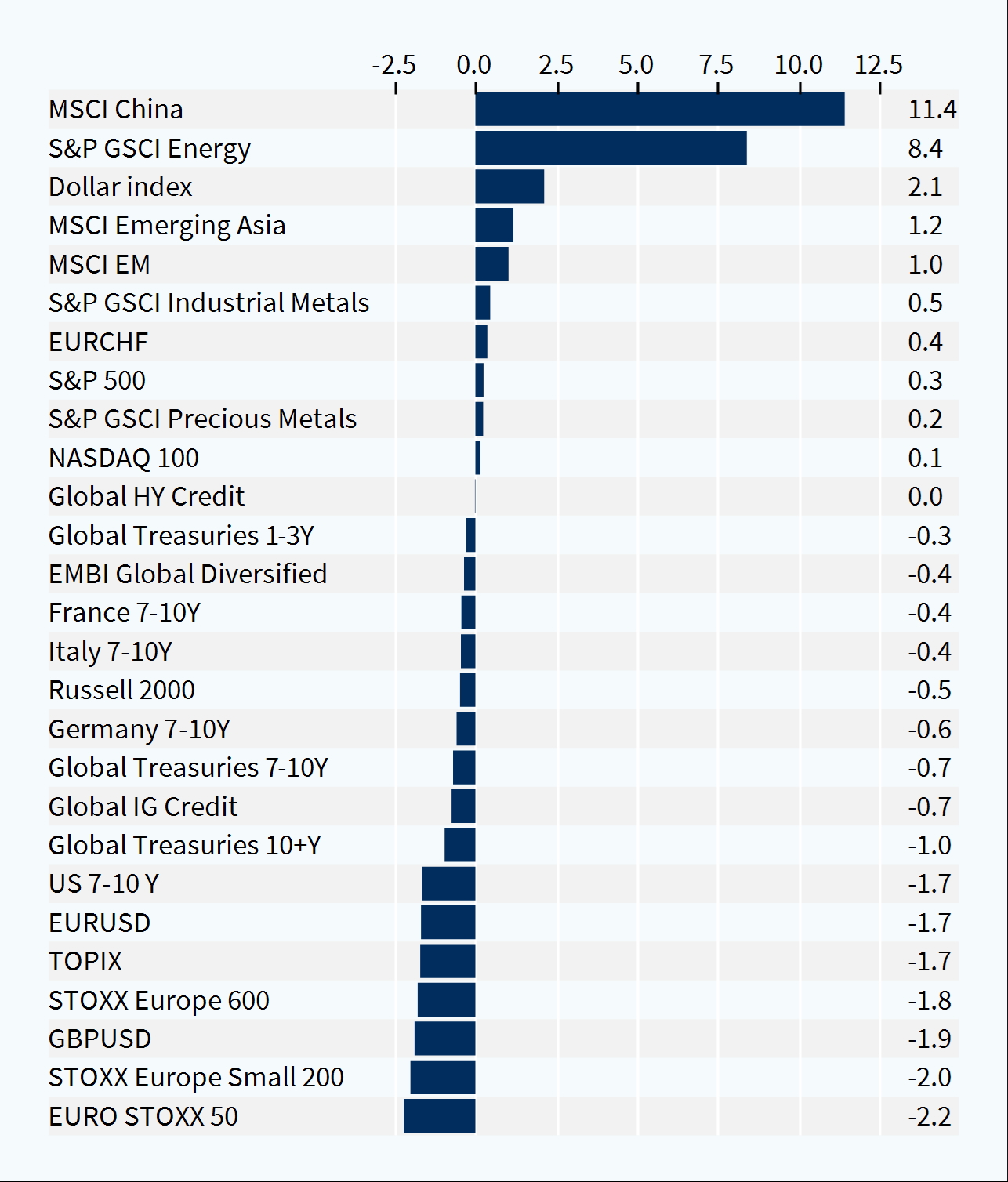

Weekly asset classes performance (%)

Copyright © 2024 Kepler Cheuvreux. All rights reserved.

This document is produced by Kepler Cheuvreux, an investment firm authorized by the ACPR under number 14441 and regulated by the Autorité des Marchés Financiers, incorporated in France under number RCS 413 064 841 at the following address: 112 Avenue Kleber, 75116 Paris, France (www.keplercheuvreux.com).

This document does not constitute a prospectus/regulatory document or other offering document, nor does it constitute an offer or solicitation to purchase securities or other investments. It should not be construed as an offer to sell or a proposal to buy any securities in any jurisdiction in which such an offer or proposal would be unlawful. We are not soliciting any action on the basis of this document, which is provided to our clients for general information purposes. It does not constitute an investment recommendation or a personalized recommendation, and does not take into account the investment objectives, financial situation and needs of each client. Before acting on the contents of this document, we advise you to check whether it is suitable for your particular situation and, if necessary, to seek professional advice.

The figures relating to past performances refer or relate to past periods and are not a reliable indicator of future results.

The accuracy, completeness or timeliness of information from external sources is not guaranteed, although it was obtained from sources reasonably believed to be reliable. Kepler Cheuvreux assumes no responsibility in this regard.

Information provided in this document concerning market data is retrieved from databases at a precise period of time and is subject to variations.