The “phenomenon” buy-now-pay-later is gaining momentum

918 Friday, 14 June 2024 16:52

Buy now, pay later (BNPL) is a type of short-term financing that allows consumers to make purchases and pay for them later, often interest-free.

On Monday, we learned that iPhones and iPads will soon be integrated into Affirm's "buy now, pay later" feature! This product will soon be available for Apple Pay users.

Let's bare in mind that the BNPL is not yet considered by the government in the consumption statistics! The Bank for International Settlements for its part warned that the adoption of BNPL is high among young adults, especially those with low levels of education. The report states that this is a worrying trend, given that excessive use and misunderstanding of the service can be disastrous for consumers and lead to over-indebtedness.

The Bloomberg agency calls this "phantom debt" and thinks that it will reach a staggering amount of 700 billion dollars within 4 years...

According to a survey conducted by Qualtrics on behalf of Credit Karma, 44% of Americans have used buy now, pay later products to acquire an item they needed in 2021. The volume generated in BNPL quadrupled from 2020 to 2021, from USD 24 billion to USD 100 billion. The BNPL market is expected to register a compound annual growth rate of 22.4% between 2022 and 2027.

According to the study, 34% of those who have used BNPL services, have fallen behind on one or more payments. Of those who admitted to having missed at least one payment, 72% said they believe their credit score declined as a result of missing the payment(s).

Nearly half of French (45%) and Spanish (49%) consumers surveyed have used these payment facilities for purchases over €1,000 (19.06.2023, Younited study on payment in instalments: practicality, the No. 1 selling point, ahead of free payment in France and Spain).

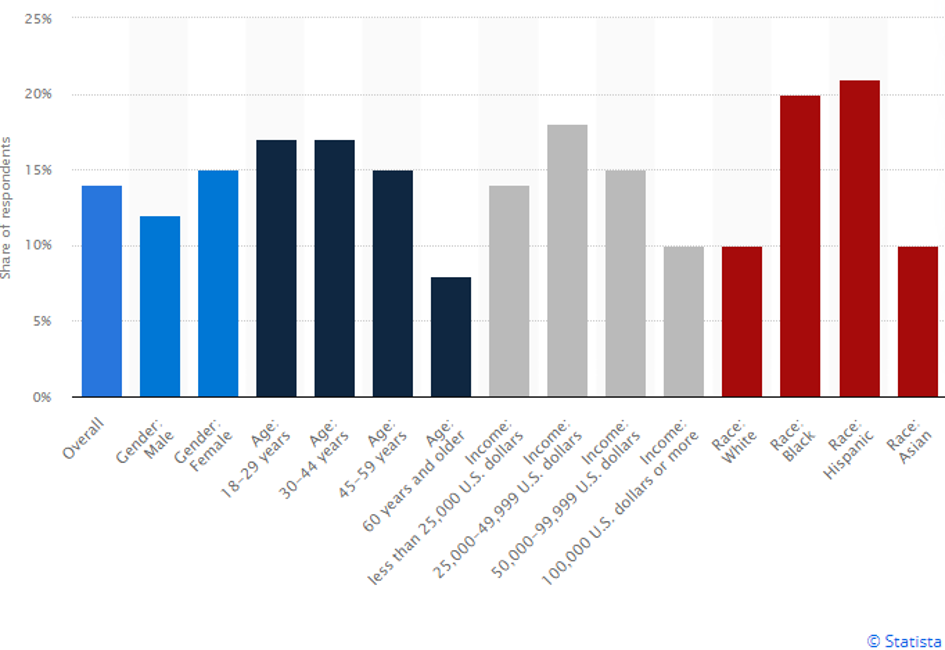

Share of respondents who said they used buy now, pay later (BNPL) in the United States in 2023, by age, gender, income, and race

Copyright © 2024 Renalco SA. All rights reserved.

You may share the link to this article freely, whether through social media, email, or other means. However, you may not copy, reproduce, or republish any part of this article in any form or by any means without prior written permission from Renalco SA.

For inquiries regarding the use or licensing of this article, please contact info@renalco.ch.