We need to talk about money, sorry

Monday, 13 May 2024 12:21

Divergent Opinions in External Articles - The opinions expressed in articles from external sources do not necessarily reflect the views of Renalco SA and are shared for informational purposes only.

The European elections are approaching (6-9 June), and the campaign is heating up. President Macron kicked off the campaign with a two-hour speech at La Sorbonne. He delivered a pretty tough yet realistic assessment of the European project, calling for “audacity” to address Europe’s problems.

His proposed solutions on economic issues sound unsurprisingly close to those Draghi laid out in a recent speech on Europe’ competitiveness. He struck the right tone, i.e. not the arrogant Frenchman he sometimes can be but a truly European advocate. The voice of France always matters but we believe it is especially true in this new global environment where France can offer nuclear deterrence, affordable nuclear power, and a strong military industrial complex to its European partners.

Macron delivered everything a European bull could hope for: Macron is calling for less red tape, more visibility for corporates on the energy front, a more unified and extended common market where companies can get scale, some EU governance changes, a larger common EU budget, and some tools to push savings into innovation. Overall, his key word “prosperity” sounds close to the “growth agenda” we suggested is needed after years of stagnation.

In one of his lighter moments, he said “we need to talk about money, sorry”, in which he discusses the levers to pull to boost private funding for innovation and investment in the energy transition. His “out of the box” proposals notably comprise the watering down of Basel III and Solvency II, as well as the addition of growth and climate to the ECB mandate. In fact, on the latter, it seems we will not get a reset of the EU green agenda. But Macron wants to put up stronger barriers against the products of countries that do not have a comparable social model or green requirements. Thus, the carbon border tax adjustment is not good enough. This part of the speech echoed the pretty direct and honest exchange he and Von der Leyen had with Xi on China’s excess capacities and subsidies last week.

Macron’s voice might be weakened by its falling approval ratings (down to only 15-17%). Nonetheless, polls continue to suggest a good momentum for Ursula Von Der Leyen’s CDU allowing her (potentially) to keep her top seat as head of the EU Commission. Right wing is rising but is very divided between ID and ECR. The latter supported by Italy’s Meloni has proven more constructive with the commission, notably on Ukraine.

Assuming a roadmap along those lines would be agreed by a new commission at the end of 2024, this could provide a strong backdrop for the recovery of European domestic stocks, but that’s a long way down the road and some investors will only believe it when they see it. Two of the bullish calls related to those elections, which we made in our weekly of 3 April, have worked well: defence stocks continued to rally and Utilities rebounded, notably the beaten down renewables sensitive to EU ambition (we actually started to push Defence in January in light of Trump’s NATO views).

A growth agenda could obviously revive European SMID Caps, which are trading at an attractive valuation. Shorter term, we see the ECB rate cuts acting as a catalyst before that. Eventually, a growth agenda would also boost new loans and trigger a wave of M&A. European asset managers such as DWS, Amundi, Partners Group or Tikehau could also benefit from a rechannelling of savings towards riskier products. Lastly, the European telecom sector has been mentioned explicitly by Draghi as a sector requiring a massive wave of consolidation. The sector looks interesting tactically as we currently favour Defensives.

Within Defensives, note that the Xi’s State visit in France didn’t trigger much noise around cognac. In our view, a Franco-German compromise on the EU investigation into Chinese auto subsidies is likely to lead to a set of reasonable tariff hikes, limiting the extent of China’s retaliations. According to our beverage analyst Richard Withagen, spirits such as Pernod, Remy or Diageo are particularly attractive here and could well accommodate tariffs increased by 10%.

Last, in today’s weekly, we update on the outcome of the earnings season. Despite a very strong Q1 in the US, expectations for 2024 were not revised much, a reflection of pretty high expectations already. To be fair though, this was only a Q1 reporting. It is still early to envisage significant revisions.

Week ahead: US: NFIB, CPI, retail sales, housing starts, IP, Eurozone: Q1 GDP, final CPI for April, China: Industrial production, retail sales, Japan: GDP, IP.

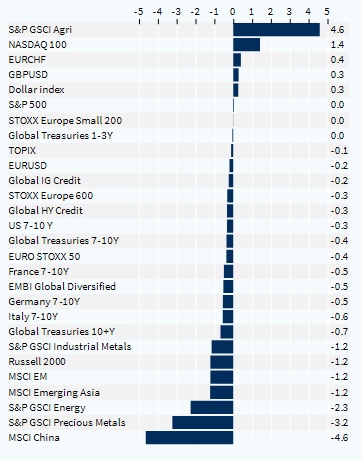

Asset classes performance - weekly (%)

Copyright © 2024 Kepler Cheuvreux. All rights reserved.

This document is produced by Kepler Cheuvreux, an investment firm authorized by the ACPR under number 14441 and regulated by the Autorité des Marchés Financiers, incorporated in France under number RCS 413 064 841 at the following address: 112 Avenue Kleber, 75116 Paris, France (www.keplercheuvreux.com).

This document does not constitute a prospectus/regulatory document or other offering document, nor does it constitute an offer or solicitation to purchase securities or other investments. It should not be construed as an offer to sell or a proposal to buy any securities in any jurisdiction in which such an offer or proposal would be unlawful. We are not soliciting any action on the basis of this document, which is provided to our clients for general information purposes. It does not constitute an investment recommendation or a personalized recommendation, and does not take into account the investment objectives, financial situation and needs of each client. Before acting on the contents of this document, we advise you to check whether it is suitable for your particular situation and, if necessary, to seek professional advice.

The figures relating to past performances refer or relate to past periods and are not a reliable indicator of future results.

The accuracy, completeness or timeliness of information from external sources is not guaranteed, although it was obtained from sources reasonably believed to be reliable. Kepler Cheuvreux assumes no responsibility in this regard.

Information provided in this document concerning market data is retrieved from databases at a precise period of time and is subject to variations.