Swiss qualität and the CHF effect

Monday, 5 February 2024 10:12

Divergent Opinions in External Articles - The opinions expressed in articles from external sources do not necessarily reflect the views of Renalco SA and are shared for informational purposes only.

Markets are looking for new catalysts after a busy end to the month.

Powell in the first FOMC meeting of 2024 said higher for a “few weeks” longer, and there has been some mixed price action post big tech earnings (Alphabet). But it did not derail the overall positive EPS surprise for the S&P 500 so far. And the latter is consistent with strong macro releases (new orders rebounded in the January’s manufacturing ISM survey/ January payrolls all the more impressive despite weather conditions). In the euro area, the CPI for January was a whisker higher than expected, but it was just noise than anything else and unlikely to alter the flexibility introduced by the ECB recently.

Overall, the picture that emerges at the end of January suggests there is no US recession in sight. Consensus growth for H1 2024 has started to be revised up, and the earnings surprise for S&P 500 companies will probably allow more confidence on demanding 2024 estimates. This could help justify rich US equity valuations. Markets remain nonetheless vulnerable to geopolitics and to the same feedback loop we have seen over the past two years: any escalation in the Middle East entails commodity risk that could reignite inflation and prevent central banks from cutting policy rates. We see this source of risk as manageable, but it is binary and likely to be somewhat permanent in the end (i.e. market will get used to that). We recently revised down our oil price forecast for 2024 to USD75/b (from USD85/b) on rising non-OPEC supply and lower OECD demand preventing a drag on inventories.

In our asset allocation, we recently reduced the bond duration bias of the portfolio, implicitly hedging our model portfolio against higher commodity prices. But our objective is to leverage the strong US macro rather than position portfolios for an escalation in the Middle East, which can backfire rapidly. In the same vein, we added to US high yield credit and added to Japanese equities on the back of the robust US macro pushing the USD higher/ the patient BoJ dragging the JPY lower. We have refrained from adding to global equities (slight Underweight) due to the rich valuation of the US equity market on high expectations, and rather toppish technical signals.

In this week’s edition, we have a look at something different. For some time, we have been wondering why the Swiss National Bank maintains a hawkish stance with inflation below the 2% ceiling since mid-last year. We anticipate a first rate cut in June, assuming inflation stabilises at current levels in January and February (lower inflation will increase the probability of a cut at the March meeting). Beyond interest rate decisions, the SNB suggests that the policy of selling foreign currencies to lift the CHF and fight inflation is coming to an end. The strong Franc has actually started to be a source of concern for the central bank, which has the tools and the means to weaken the CHF. Although fundamentals, i.e. trade surpluses/competitiveness of Switzerland, do not suggest any long-term CHF weakness, we believe that some reversal is due in 2024.

- A depreciation of the CHF would be a positive for Swiss equities overall, as most are operationally exposed to markets abroad. The Swiss equity market is among our most preferred geographies in Europe. It has been lagging over the last year, but we think its defensive features (lowest beta in our universe) will ultimately prevail in the next six months. Valuation-wise, the Swiss equity market trades in line with its ten-year average.

- We also show in our report the Swiss stocks in our coverage that stand to benefit the most from a weakening CHF (highest earnings sensitivities), as shown in the last report published by our Swiss research team (link). We find that many SMID caps are very sensitive. Within our Swiss top picks, we would highlight Burckhardt, Sika, Nestlé and Tecan as potential beneficiaries.

Week ahead: a quiet week in developed markets. China will see the CPI/ PPI release for January. The next big milestone apart from the ongoing earnings season will be the US CPI on 13 February.

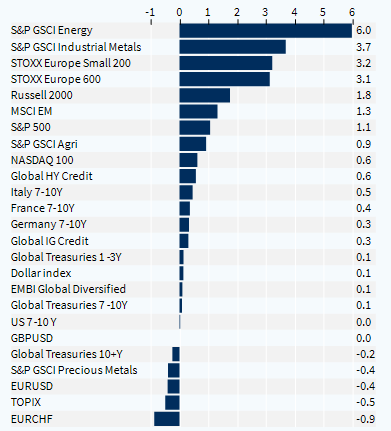

Weekly asset classes performance (%)

Copyright © 2024 Kepler Cheuvreux. All rights reserved.

This document is produced by Kepler Cheuvreux, an investment firm authorized by the ACPR under number 14441 and regulated by the Autorité des Marchés Financiers, incorporated in France under number RCS 413 064 841 at the following address: 112 Avenue Kleber, 75116 Paris, France (www.keplercheuvreux.com).

This document does not constitute a prospectus/regulatory document or other offering document, nor does it constitute an offer or solicitation to purchase securities or other investments. It should not be construed as an offer to sell or a proposal to buy any securities in any jurisdiction in which such an offer or proposal would be unlawful. We are not soliciting any action on the basis of this document, which is provided to our clients for general information purposes. It does not constitute an investment recommendation or a personalized recommendation, and does not take into account the investment objectives, financial situation and needs of each client. Before acting on the contents of this document, we advise you to check whether it is suitable for your particular situation and, if necessary, to seek professional advice.

The figures relating to past performances refer or relate to past periods and are not a reliable indicator of future results.

The accuracy, completeness or timeliness of information from external sources is not guaranteed, although it was obtained from sources reasonably believed to be reliable. Kepler Cheuvreux assumes no responsibility in this regard.

Information provided in this document concerning market data is retrieved from databases at a precise period of time and is subject to variations.