Sunny skies for the UK equity market

Monday, 29 April 2024 10:09

Divergent Opinions in External Articles - The opinions expressed in articles from external sources do not necessarily reflect the views of Renalco SA and are shared for informational purposes only.

April is coming to an end and it has been a rough ride, especially in fixed income markets after the sharp repricing of inflation and rate expectations.

In equity markets, substantial rotations have been taking place from momentum to value, or said differently from Technology and Consumer Discretionary stocks to inflation hedges such as Energy, Metals & Mining, and Banks. But the overall price action remains relatively benign, with the STOXX Europe 600 down by less than 1% so far in April and the S&P 500 down 3%.

The key question is whether the April pattern will continue going forward or whether the bullish impetus seen in Q1 will be back at the forefront. From our perspective, growth dynamics remain supportive for risk assets, and the most recent macro releases and business surveys do not point to a material slowdown in growth. In the US, while the first estimate of real GDP growth in Q1 came in somewhat weaker than expected, the details of the report proved quite constructive, as it emerged that the momentum in private domestic final demand had remained very robust. As shown by the latest report on personal income and outlays, one big reason for this is the ongoing strength of personal consumption, which continues to benefit from a tight labour market and a low savings rate. Yet, US equity valuations remain stretched, which puts a cap on expected returns going forward.

In our view, it makes sense to keep a balanced equity portfolio in terms of Growth and Value styles. In the short term, bond yields could continue to drift higher with the 10Y Treasury yield potentially retesting the critical 5% level until the next CPI release (15 May), which may provide investors with some relief that the recent uptick in inflation was just a bump in the disinflation road. Meanwhile, geopolitical tensions could also keep commodity prices on edge. We have seen a big rotation towards Cyclical Value sectors (Metals & Mining OW, Banks N), but we think the Defensive Value sectors could also rebound, such as Telecoms (Strong OW), Energy (OW).

Along those lines, one market which we singled out as a potential winner in our latest quarterly report was the UK and more specifically the FTSE 100, which, as an aside, does not reflect UK macro dynamics at all. We like its defensive/ value/ inflation hedge features due to the skew in its composition towards energy/ metals and mining/ financials. In addition, the FTSE 100 is sensitive to currency movements in a similar fashion to the Nikkei or the Swiss market. Said differently, the FTSE 100 outperforms the MSCI World when the GBP depreciates vs. the USD. In our view, GBP depreciation might continue going forward, not only on the back of the electoral calendar, which is likely to see a labour government in 2025, but mainly on the back of a divergence between the inflation dynamics in the UK and the US. While the disinflation momentum has stalled in the US, it remains alive in the UK. This is likely to lead to different monetary policy outcomes, whereby the Fed might delay rate cuts while the BoE may well proceed with them.

Week ahead: A critical week ahead on both the macro and the corporate earnings front. The FOMC meeting on 1 May and the April job market report in the US on 3 May will be key market movers. In the euro area, the CPI will be available on 30 April, and in China, the PMI will also help in gauging whether the rebound in non-manufacturing activity last month has extended into April. On the corporate earnings front, 174 S&P 500 companies will report, of which Apple and Amazon will be the mega-caps to watch closely. In Europe, 64 companies are due to report, including a flurry of banks: HSBC, Societe Generale, Credit Agricole, ING, Raiffeisen, Danske Bank, Intesa Sanpaolo, BBVA, Santander, Caixabank, and Erste bank. In the automotive sector, Mercedes Benz and Volkswagen will report, while in the pharma sector Novo Nordisk will also attract attention.

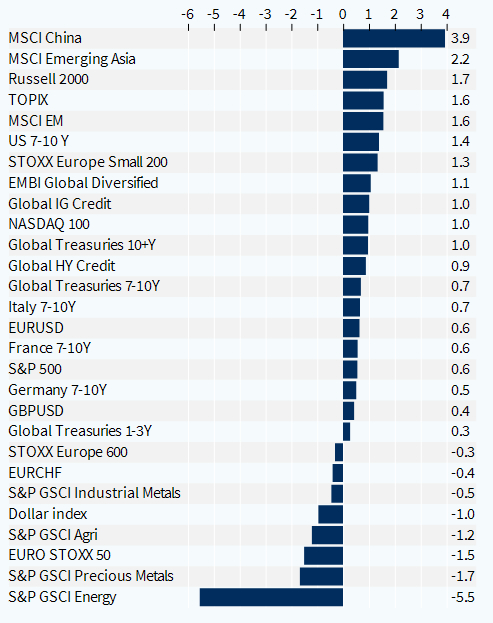

Asset classes performance - month to date (%)

Copyright © 2024 Kepler Cheuvreux. All rights reserved.

This document is produced by Kepler Cheuvreux, an investment firm authorized by the ACPR under number 14441 and regulated by the Autorité des Marchés Financiers, incorporated in France under number RCS 413 064 841 at the following address: 112 Avenue Kleber, 75116 Paris, France (www.keplercheuvreux.com).

This document does not constitute a prospectus/regulatory document or other offering document, nor does it constitute an offer or solicitation to purchase securities or other investments. It should not be construed as an offer to sell or a proposal to buy any securities in any jurisdiction in which such an offer or proposal would be unlawful. We are not soliciting any action on the basis of this document, which is provided to our clients for general information purposes. It does not constitute an investment recommendation or a personalized recommendation, and does not take into account the investment objectives, financial situation and needs of each client. Before acting on the contents of this document, we advise you to check whether it is suitable for your particular situation and, if necessary, to seek professional advice.

The figures relating to past performances refer or relate to past periods and are not a reliable indicator of future results.

The accuracy, completeness or timeliness of information from external sources is not guaranteed, although it was obtained from sources reasonably believed to be reliable. Kepler Cheuvreux assumes no responsibility in this regard.

Information provided in this document concerning market data is retrieved from databases at a precise period of time and is subject to variations.