Get ready for the first ECB rate cut

Monday, 3 June 2024 11:31

Divergent Opinions in External Articles - The opinions expressed in articles from external sources do not necessarily reflect the views of Renalco SA and are shared for informational purposes only.

Many aspects of the market and economy bring to mind the principles of yin and yang: the West versus the East; some economic activities flourishing while others in recession; rich consumers versus poor; and deflation in some areas and inflation in others. Like in Chinese philosophy, these opposing forces have worked to establish an equilibrium in the markets that will be tested in the very near term.

The next two weeks will be important on the macro front, with key central bank meetings and two interesting data points in the US: the May job market report followed by the CPI, which could confirm the weaker growth and inflation momentum that seemed to be taking shape in the US in April. No doubt that there is significant potential for rates to edge lower if such signals appear to form a pattern.

Would a weak job market print be good or bad for stocks? Markets will vacillate between “what helps the Fed to cut faster is positive for the risk-free rate and equity valuation” and “I should prepare for earnings cuts”. As a first step, we lean towards the positive interpretation for stocks, but the negative interpretation could soon follow suit if any slowdown turns out to be too sharp. We are definitely not there yet. In contrast, if the April data proves an outlier (i.e. strong job creation in May), it clearly risks feeding the “higher for longer” theme that brings volatility in markets.

Meanwhile, the outcome of the OPEC+ meeting over the weekend is also a tailwind to tame inflation. While extending oil production cuts into Q3-2024, the oil cartel will be adding output from October onwards, if oil prices stay sufficiently high. Based on the path published by Saudi officials, OPEC+ output will be more than 500,000 b/d by December, 1.8mb/d higher by mid-2025.

In Europe, citizens will elect their members of parliament amid significant geopolitical tensions and controversies with regards to the far-right in Germany. European elections will probably be irrelevant for markets in the short term, but the outcome will influence the composition of the EU Commission in H2 and hence the direction of travel for the EU. Has Draghi’s call for “radical change” any chance of becoming concrete in 2025? We have put forward two trade ideas on this theme lately: renewables and defense in equities, that continue to appear relevant to us.

Then, the first ECB rate cut is largely expected this week. The ECB will probably remain cautious though, and not pre-commit too much. Market expectations are consistent with that, in our view.

Ahead of these critical milestones that will shed light on inflation/ rate concerns that continue to cause significant market gyrations, we reiterate our OW on the Metals & Mining sector. It is the typical sector at the crossroads between globalization and environmental challenges, and at the same time deeply anchored in the digitalization and energy transition themes. The sector performed well recently thanks to the jump in metal prices since February, driven by supply disruptions and trade restrictions (imposed by the US and UK on Russian metals).

In the short term, supply disruption (Panama) triggered a rally in copper prices. Our partner Macquarie cautions that the price rise will stimulate scrap supply helping to balance the market. Hence their new forecast is actually pretty close to current levels. They expect copper to average $9,800/t in Q3,before recovering back up to $10,500/t average in Q4 if the forecast deficit for the full year starts to materialise.

In the long run, energy transition is the biggest theme driving the sector. It is taking over from China’s slowing urbanisation as the primary engine of global demand growth for metals. In particular, copper will play a critical role for clean energy technologies (power grids, solar panels, wind farms) and also for electric mobility (electric vehicles). The rise of artificial intelligence is also boosting the demand for copper as it is a crucial component for data centers.

Supply constraints for critical metals such as copper remain challenging, as a result of low capex and rising environmental constraints. This is a tailwind for prices, and we expect corporate activity to continue in this context, despite the recent hurdles to close the BHP vs Anglo American deal.

Week ahead: ECB meeting, EMU retail sales (April), European Parliament elections. US ISM and job market report. China trade data.

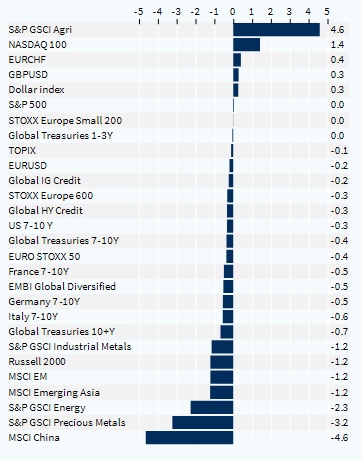

Asset classes performance - weekly (%)

Copyright © 2024 Kepler Cheuvreux. All rights reserved.

This document is produced by Kepler Cheuvreux, an investment firm authorized by the ACPR under number 14441 and regulated by the Autorité des Marchés Financiers, incorporated in France under number RCS 413 064 841 at the following address: 112 Avenue Kleber, 75116 Paris, France (www.keplercheuvreux.com).

This document does not constitute a prospectus/regulatory document or other offering document, nor does it constitute an offer or solicitation to purchase securities or other investments. It should not be construed as an offer to sell or a proposal to buy any securities in any jurisdiction in which such an offer or proposal would be unlawful. We are not soliciting any action on the basis of this document, which is provided to our clients for general information purposes. It does not constitute an investment recommendation or a personalized recommendation, and does not take into account the investment objectives, financial situation and needs of each client. Before acting on the contents of this document, we advise you to check whether it is suitable for your particular situation and, if necessary, to seek professional advice.

The figures relating to past performances refer or relate to past periods and are not a reliable indicator of future results.

The accuracy, completeness or timeliness of information from external sources is not guaranteed, although it was obtained from sources reasonably believed to be reliable. Kepler Cheuvreux assumes no responsibility in this regard.

Information provided in this document concerning market data is retrieved from databases at a precise period of time and is subject to variations.