China Trade Wars

Monday, 27 May 2024 10:10

Divergent Opinions in External Articles - The opinions expressed in articles from external sources do not necessarily reflect the views of Renalco SA and are shared for informational purposes only.

Post Nvidia’s results last week, the earnings season is now well behind us. We are now straddling two worlds, digesting the recent corporate news flow and focusing our minds on upcoming macro developments, with the expected rate cut from the ECB on 6 June and a critical dot plot from the Fed on 12 June.

In the meantime, these relatively quiet weeks provide an opportunity to take stock of recent events, which are leading us to reduce the sensitivity of our recommendations to the geopolitical newsflow relating to China for the following reasons:

- First, trade sanctions remain a hot topic, not only related to US-China but also to Europe-China. The EU probe into China’s EV exports is due to come to an end in the coming weeks, and China has already announced potential retaliation measures against EU carmakers if Europe imposes restrictions. We stay UW on the European automotive sector, especially in this context. Then, the US election campaign will now kick into a higher gear, and we expect the US stance with regards to China to turn increasingly hawkish in H2.

- Second, the fragile equilibrium between China and Taiwan has been altered by the newly inaugurated President Lai-Ching-te, who strayed from the path taken by his more cautious predecessor with regards to sovereignty. We don’t expect China to invade Taiwan in the medium term, but we expect tensions to remain elevated and to generate market noise.

- Third, China’s support package for the real estate sector is unlikely, in our view, to dramatically change the picture with regards to Chinese consumer spending and confidence.

- Fourth, the Chinese equity market has rallied significantly since the trough in late January, and we are more comfortable with taking profits on our EM Asia equity exposure in this context.

Against this backdrop, we are making a few changes in our sector and asset allocation recommendations. With regards to the latter, we are switching from EM Asia to EM ex-China within our equity bucket. This is more diversified and removes the direct Chinese risk while being heavily exposed to India, which remains appealing, as the general election has entered its final stage and should see the reappointment of Narendra Modi in early June.

Within European equity sectors, we are reducing the exposure to Luxury Goods from OW to N. The sector remains heavily exposed to China, and we had hopes that consumer confidence could recover with further support to the housing market. Yet, recent measures, although encouraging, don’t appear sufficient to change the tide in the near term. Meanwhile, the Luxury sector continues to face affordability headwinds following years of price increases. Additionally, US demand could weaken further in H2 if a soft landing takes shape, as we expect. The sector is also exposed to the risk of retaliation from China, should trade tensions escalate further.

At the same time, we are upgrading the Pharma sector from N to OW. The sector fits our general call on Defensives. Outside of Novo, it is not richly valued despite secular growth drivers and strong balance sheets. US elections still represent a risk, but so far the theme of drug affordability has been eclipsed by more pressing issues, such as immigration.

This is consistent with our positive view on the Swiss equity market. On top of the defensive features of the Swiss market, its health care bias and negative correlation to currency movements are appealing. The monetary policy meeting of the Swiss National Bank on 20 June could see another rate cut, and we believe there is additional room for the CHF to depreciate vs. the USD. For non-domestic investors, we thus recommend increasing exposure to the Swiss market but hedging the currency risk.

Week ahead: the euro area CPI for May as well as the US PCE price index, the Fed’s preferred measure of inflation, will again put the spotlight on inflation trends. In the US, the consumer confidence survey from the Conference Board could be a market mover, considering the weaker signals recently. In China, the May PMI will be released.

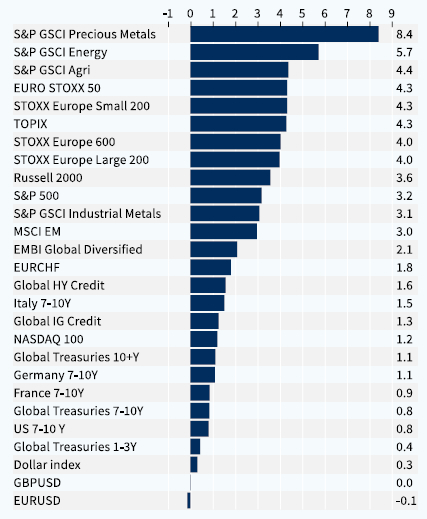

Asset classes performance - weekly (%)

Copyright © 2024 Kepler Cheuvreux. All rights reserved.

This document is produced by Kepler Cheuvreux, an investment firm authorized by the ACPR under number 14441 and regulated by the Autorité des Marchés Financiers, incorporated in France under number RCS 413 064 841 at the following address: 112 Avenue Kleber, 75116 Paris, France (www.keplercheuvreux.com).

This document does not constitute a prospectus/regulatory document or other offering document, nor does it constitute an offer or solicitation to purchase securities or other investments. It should not be construed as an offer to sell or a proposal to buy any securities in any jurisdiction in which such an offer or proposal would be unlawful. We are not soliciting any action on the basis of this document, which is provided to our clients for general information purposes. It does not constitute an investment recommendation or a personalized recommendation, and does not take into account the investment objectives, financial situation and needs of each client. Before acting on the contents of this document, we advise you to check whether it is suitable for your particular situation and, if necessary, to seek professional advice.

The figures relating to past performances refer or relate to past periods and are not a reliable indicator of future results.

The accuracy, completeness or timeliness of information from external sources is not guaranteed, although it was obtained from sources reasonably believed to be reliable. Kepler Cheuvreux assumes no responsibility in this regard.

Information provided in this document concerning market data is retrieved from databases at a precise period of time and is subject to variations.