Short Notes

by Michel Schiffelholz, CIO

Evolution of the number of publicly traded companies

Monday, 13 May 2024 13:25

The evolution of the number of publicly traded companies in the United States since the 1990s is fascinating. At that time, there were approximately 8,000 publicly traded companies, but this number has significantly decreased to around 4,600 in 2022.

Mergers and acquisitions have played a major role in this consolidation. Large companies have absorbed many smaller businesses over time. Technology giants such as Google, Microsoft, Apple, Meta (formerly Facebook), Amazon, and Nvidia, which collectively have a market capitalization of over $12.1 trillion, have impressively acquired 875 companies on their own.

Here are some notable acquisitions:

- Apple: Beats Electronic, Shazam

- Amazon: Whole Foods Market, Ring

- Alphabet (Google’s parent company): YouTube, Nest Labs

- Meta (formerly Facebook): Instagram, Oculus VR

- Nvidia: Mellanox Technologies

- Tesla: SolarCity

- Microsoft: LinkedIn, Skype, Activision Blizzard

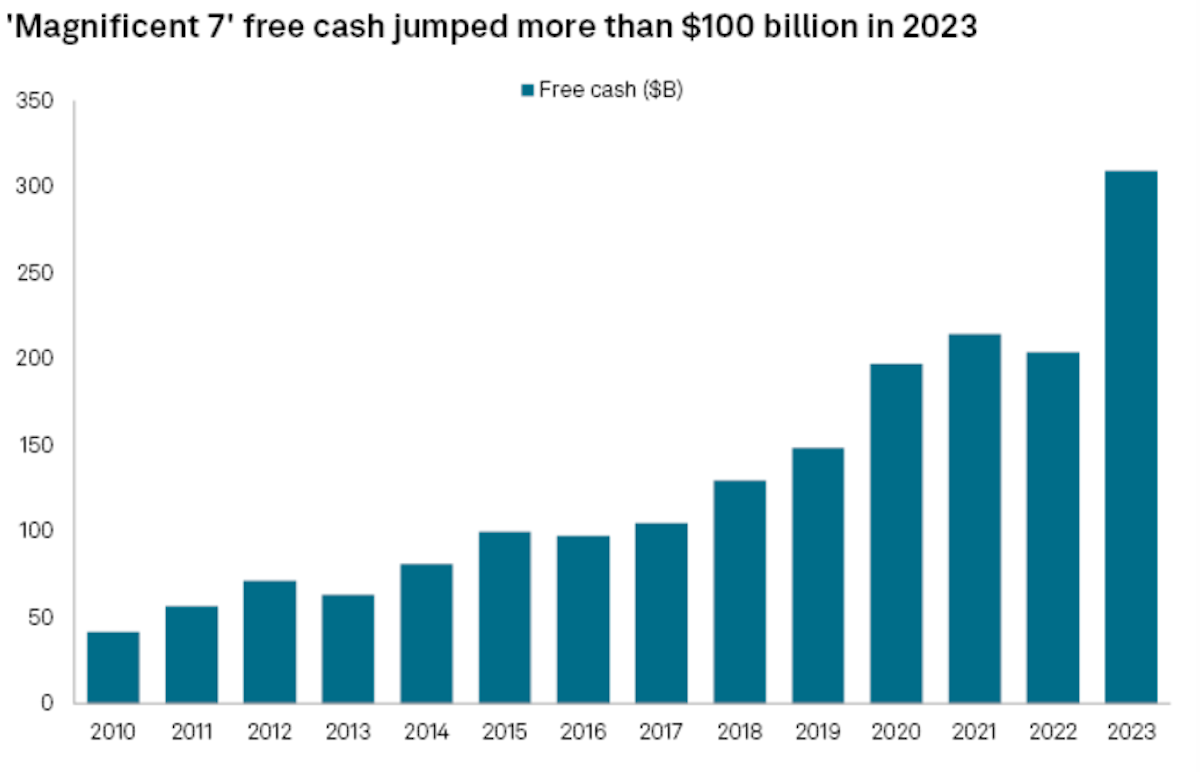

The free cash flow of the “Seven Magnificents” increased by 34% in 2023 compared to the previous year, reaching an impressive $309.2 billion.

(source: S&P Global Market Intelligence. Copyright © 2024 S&P Global.)

Data compiled Feb. 5, 2024. Total levered free cash flow reported by the "Magnicent 7, which are Meta Platforms Inc., Alphabet Inc., Amazon.com Inc., Apple Inc., Tesla Inc., NVIDIA Corp. and Microsoft Corp. Nvidia's fourth-quarter numbers are estimated.

However, new merger guidelines published in December 2023 by the U.S. Department of Justice and the Federal Trade Commission make mergers more complex. These guidelines now consider certain transactions illegal at lower post-merger industrial concentration thresholds than before. Additionally, if a transaction is part of a series of acquisitions, the entire series could be scrutinized by regulators. In 2023, the Seven Magnificents spent only $310 million on six transactions.

Copyright © 2024 Renalco SA. All rights reserved.

You may share the link to this article freely, whether through social media, email, or other means. However, you may not copy, reproduce, or republish any part of this article in any form or by any means without prior written permission from Renalco SA.

For inquiries regarding the use or licensing of this article, please contact info@renalco.ch.