Short Notes

by Michel Schiffelholz, CIO

The outperformance of some stocks vs. the indices is not recent

Tuesday, 30 July 2024 11:40

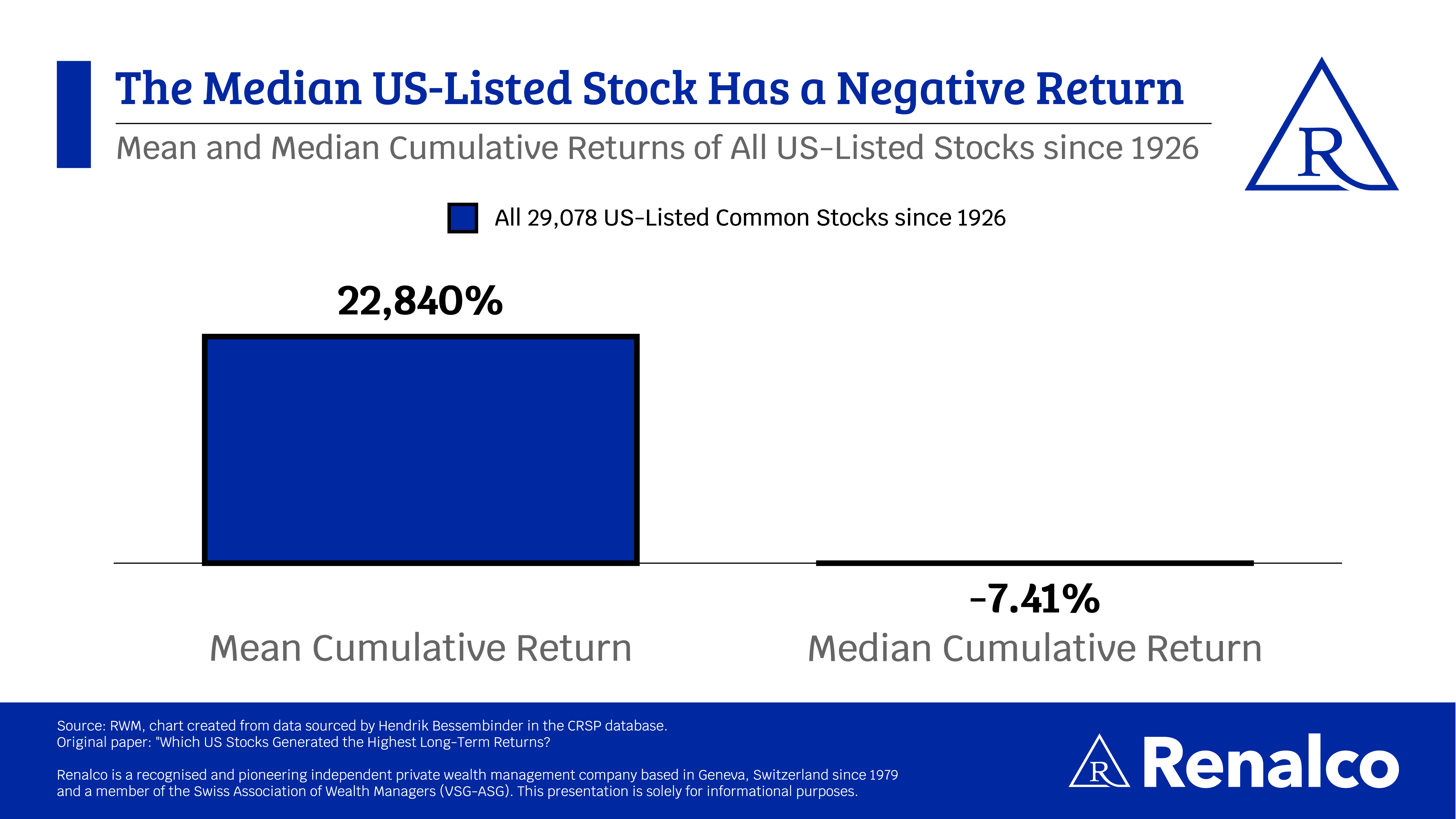

Spencer Hakimian, founder of Tolou Capital, highlights an intriguing aspect of stock market investing. While a small percentage of stocks historically drive the majority of market returns, the distribution is highly skewed. Specifically, only 4% of stocks account for all equity market returns over the past century. Another study reveals that the top-performing 2.4% of firms contributed to the entire $75.7 trillion in net global stock market wealth creation from 1990 to December 2020. This skewness poses a challenge for individual investors aiming to consistently outperform the market through stock selection.

In summary, although individual stocks can yield substantial returns, the long-term skewed nature of stock performance and the difficulty in identifying winning stocks make it virtually impossible to consistently outperform an index. As the saying goes, “Don’t search for the needle in the haystack—just buy the haystack.”

Copyright © 2024 Renalco SA. All rights reserved.

You may share the link to this article freely, whether through social media, email, or other means. However, you may not copy, reproduce, or republish any part of this article in any form or by any means without prior written permission from Renalco SA.

For inquiries regarding the use or licensing of this article, please contact info@renalco.ch.