Short Notes

by Michel Schiffelholz, CIO

Effects of the US Presidential Elections on the Stock Markets

Tuesday, 22 October 2024 15:22

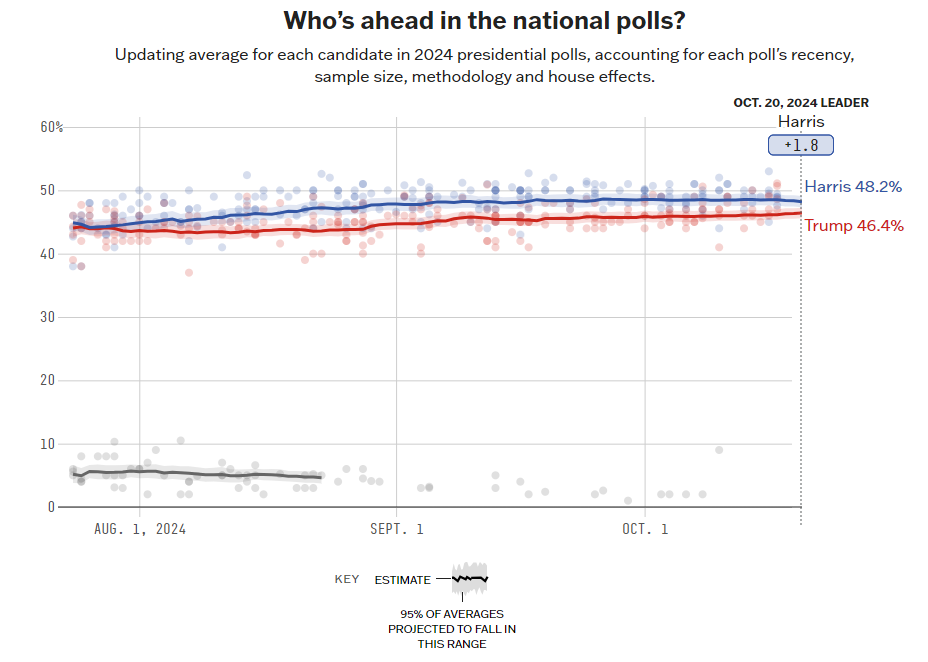

Trump is clearly regaining momentum in the presidential race, both with online betting sites and in polls. A recent NBC News poll shows that K. Harris’ 5-point lead from the previous month has now disappeared, and the two candidates are neck and neck.

U.S. presidential election years often have a significant impact on stock markets.

- Average returns: Since 1950, the S&P 500 has averaged returns of 9.1% during election years.

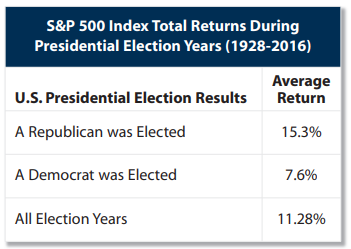

- Party comparison: Between 1928 and 2016, the S&P 500’s returns averaged 15.3% under a Republican president, compared to 7.6% under a Democratic president.

- Long-term performance: Stock markets tend to grow over the long term, regardless of the party in power. Under President Ronald Reagan (Republican), the market rose by 119%, and under Bill Clinton (Democrat), by 241%.

Financial markets often react sensitively to uncertain election outcomes. Increased volatility and reduced trading volumes before and after uncertain elections are common. Electoral uncertainty can also affect exchange rates and sectoral reactions, such as in the health and energy sectors, which can react strongly to election results due to potential regulatory and subsidy implications.

Some presidential elections have had a significant impact on financial markets due to political uncertainty and potential changes in economic policies.

- 2000 U.S. presidential election: The election between George W. Bush and Al Gore was marked by a long period of uncertainty due to the recount of votes in Florida. This uncertainty led to increased volatility in financial markets.

- 2016 U.S. presidential election: Donald Trump’s unexpected victory initially caused futures markets to fall, but markets quickly rebounded and reached new highs on expectations of tax cuts and deregulation.

Data Source: Morningstar/Ibbotson Associates.

Copyright © 2024 Renalco SA. All rights reserved.

You may share the link to this article freely, whether through social media, email, or other means. However, you may not copy, reproduce, or republish any part of this article in any form or by any means without prior written permission from Renalco SA.

For inquiries regarding the use or licensing of this article, please contact info@renalco.ch.