Handle with care

753 Monday, 6 May 2024 11:17

Divergent Opinions in External Articles - The opinions expressed in articles from external sources do not necessarily reflect the views of Renalco SA and are shared for informational purposes only.

Markets have been in search of a new equilibrium in recent weeks, weighing supportive data on growth and corporate earnings against lingering concerns about geopolitics, inflation, and rates.

Most recent macro releases nonetheless suggest that the US consumer could be poised for a softer spending trend going forward. Meanwhile, geopolitical tensions have marginally eased, resulting in Brent oil prices dipping below USD85/b, a tailwind for addressing inflation and rate concerns.

On top of the improving geopolitical newsflow, the Federal Reserve delivered a marginally dovish message last week, putting an emphasis on the Fed’s maximum employment objective and announcing a tapering of the quantitative tightening programme. Lastly, the US job market report for April came in below consensus expectations, suggesting that inflation concerns, and bond yields could ease substantially over the rest of Q2. In that respect, the next CPI datapoint for May will be critical to confirm renewed green shoots on the disinflation front.

The relief in bond yields is supportive for small and mid-caps and puts inflation hedges such as commodities and energy stocks at risk. Meanwhile, we remain positive on EM assets, which are also sensitive to Treasury yields. EM equities have experienced a stellar run lately, especially Chinese equities, and we maintain an Overweight stance on EM Asia equities (10% in our model portfolio). However, we have been reluctant to increase our exposure to this asset class on the back of continued trade tensions between the US and China, and the lack of visibility on China’s real estate meltdown. That said, we see the rise of the middle class in EMs as an attractive theme to stay exposed to.

As a result, in recent months we have complemented our OW stance on EM Asia with European sectors & companies exposed to EM consumers, such as Luxury Goods (Overweight). In this report, we upgrade another European sector exposed to the EM consumer, namely Household and Personal Care (hence the title of this report). The sector also has a defensive bias, which we favour at the moment. Admittedly, the two big players in the field are L’Oreal and Unilever, both rated Buy by our analysts. Why this upgrade now? Because the earnings season has unveiled improving and better-than-expected volumes. Latam is reportedly doing fantastically well, and in Asia ex-China volumes are also picking up, although the Chinese consumer remains a source of uncertainty. In addition, the valuation of this quality sector has also returned to appealing levels, trading at 19x forward earnings, which is close to the lowest levels observed in the past decade.

Week ahead: After busy days at the start of the month, the calendar of macro releases is set to become lighter. In the US, we will have the University of Michigan consumer sentiment survey for April. In Europe, keep an eye on the EMU producer price index and retail sales, while the Bank of England will meet and is expected to maintain a dovish bias. In terms of corporate earnings, the newsflow will start to become lighter with regards to the S&P 500, with 80% of the companies having already reported. In Europe, 75 companies listed in the STOXX Europe 6000 will report, including UBS and Unicredit in banks; Bouygues, Ferrovial, and Leonardo in industrials; and BMW and Ferrari in autos (or luxury for the latter?).

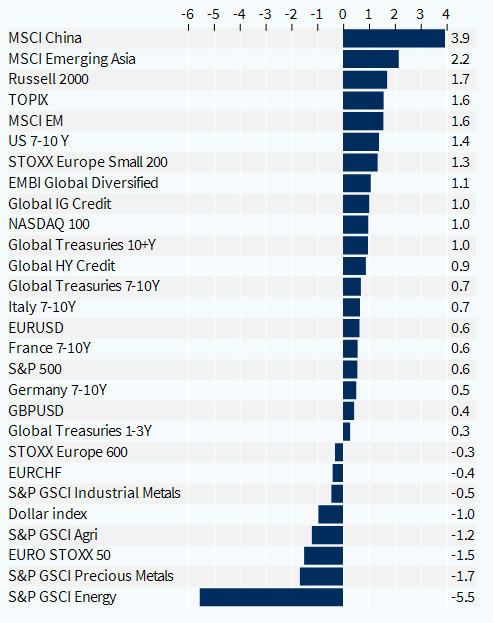

Asset classes performance - weekly (%)

Copyright © 2024 Kepler Cheuvreux. All rights reserved.

This document is produced by Kepler Cheuvreux, an investment firm authorized by the ACPR under number 14441 and regulated by the Autorité des Marchés Financiers, incorporated in France under number RCS 413 064 841 at the following address: 112 Avenue Kleber, 75116 Paris, France (www.keplercheuvreux.com).

This document does not constitute a prospectus/regulatory document or other offering document, nor does it constitute an offer or solicitation to purchase securities or other investments. It should not be construed as an offer to sell or a proposal to buy any securities in any jurisdiction in which such an offer or proposal would be unlawful. We are not soliciting any action on the basis of this document, which is provided to our clients for general information purposes. It does not constitute an investment recommendation or a personalized recommendation, and does not take into account the investment objectives, financial situation and needs of each client. Before acting on the contents of this document, we advise you to check whether it is suitable for your particular situation and, if necessary, to seek professional advice.

The figures relating to past performances refer or relate to past periods and are not a reliable indicator of future results.

The accuracy, completeness or timeliness of information from external sources is not guaranteed, although it was obtained from sources reasonably believed to be reliable. Kepler Cheuvreux assumes no responsibility in this regard.

Information provided in this document concerning market data is retrieved from databases at a precise period of time and is subject to variations.