Goldilocks vibes

537 Monday, 2 September 2024 14:20

Divergent Opinions in External Articles - The opinions expressed in articles from external sources do not necessarily reflect the views of Renalco SA and are shared for informational purposes only.

After the Jackson Hole gathering a week ago, markets were looking to Nvidia as the next big catalyst. But in the end, neither Nvidia nor Jay Powell moved markets very much after a positive string of macro data points sent goldilocks vibes through the market: an upward revision of Q2 US real GDP, a very strong US consumption growth print in July, and more positive PCE inflation (now below 2% on a 3M sequential basis!).

However, that doesn’t mean those events didn’t raise a lot of questions:

- Jackson Hole: Nothing was said apart from the direction of the ship. Can the Fed cut very fast (as markets currently expect) even if real growth stays strong, as long as inflation goes in the right direction? If so, it would mean the Fed is inclined to stay ahead of a potential labour market downturn that could accelerate at any time without notice.

- Domestic consumption: With the savings rate of US consumers having revisited lows with the July data, could the ongoing softening of the labour market imply a sharp reversal of consumption patterns?

- Nvidia: earnings surprises are normalising (around 5% positive revisions for EPS 2026E vs. 10% in the previous quarter), but lower interest rates should remain supportive for the Growth/ Tech/ AI theme.

In any case, neither bond yields nor Fed expectations moved very much last week despite the bullish macro surprises. The markets’ focus will obviously move to the US labour report coming out this Friday, but for investors who would be afraid of a big jump in the US or EUR 10Y, we would highlight that:

- The long end of the curve is unlikely to be much influenced by a potential repricing of Fed rate expectations in the coming weeks. Fed funds futures suggest the central bank is expected to cut rates by a cumulated 100 bp into year-end, which appears generous in light of recent growth surprises. We stay constructive on bond duration as a result.

- Commodity prices have been heading lower, which is positive for disinflation (notably food commodities). The OPEC meeting of 2 October will be important and is potentially a downside trigger for the oil price. We show in the note a chart illustrating that at $80/bl, the brent price contribution to disinflation will become less supportive by year-end. We expect the oil price to trend below $70 if OPEC confirms the gradual phase-out of oil supply cuts. In the case of food commodities, our partner Rabo Bank remains cautious on the outlook for cereal prices on the back of a big supply glut.

Even if they stay at current levels, current food commodity prices should increasingly be a tailwind for food & beverage stocks, on which we reiterate our OW in this report. We note the earnings momentum of European players remains negative, but the headwinds are moderating. Disinflation has been negative so far: volumes are not picking up much yet, but the contribution from prices has been weak.

- Moreover, geopolitics have been a big question mark for spirits exporters. The rise of Harris in the polls is positive news for European exporters because a Trump-led trade war between China and US would have collateral effects on Europe. China also appears willing to holds talks with the EU before hitting cognac-makers.

- Finally, we emphasise that food and beverage stocks remain “DCF stocks” (Discounted Cash Flows valuation model) and enjoy lower bond yields. Stability in earnings estimates is probably needed for that effect to work. It looks like the board of Nestlé (38% of the MSCI Europe Food, Beverage and Tobacco index) heard the market’s message this summer. We find that reassuring.

- Most preferred stocks: Danone, Heineken

- Least preferred stocks: JDE Peet’s, Coca-Cola Europacific Partners

Week ahead: in the US, the ISM business survey (August), the Job Openings and Labour Turnover survey (July), and non-farm payrolls (August) will be available. In the euro area, retail sales and the producer price index (both for July) will be available.

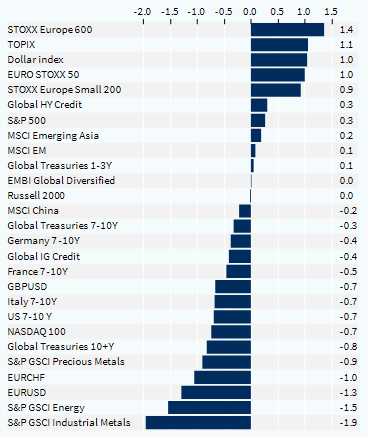

Cross-asset performance (last week, %)

Copyright © 2024 Kepler Cheuvreux. All rights reserved.

This document is produced by Kepler Cheuvreux, an investment firm authorized by the ACPR under number 14441 and regulated by the Autorité des Marchés Financiers, incorporated in France under number RCS 413 064 841 at the following address: 112 Avenue Kleber, 75116 Paris, France (www.keplercheuvreux.com).

This document does not constitute a prospectus/regulatory document or other offering document, nor does it constitute an offer or solicitation to purchase securities or other investments. It should not be construed as an offer to sell or a proposal to buy any securities in any jurisdiction in which such an offer or proposal would be unlawful. We are not soliciting any action on the basis of this document, which is provided to our clients for general information purposes. It does not constitute an investment recommendation or a personalized recommendation, and does not take into account the investment objectives, financial situation and needs of each client. Before acting on the contents of this document, we advise you to check whether it is suitable for your particular situation and, if necessary, to seek professional advice.

The figures relating to past performances refer or relate to past periods and are not a reliable indicator of future results.

The accuracy, completeness or timeliness of information from external sources is not guaranteed, although it was obtained from sources reasonably believed to be reliable. Kepler Cheuvreux assumes no responsibility in this regard.

Information provided in this document concerning market data is retrieved from databases at a precise period of time and is subject to variations.