Can Germany be saved?

452 Monday, 18 November 2024 12:53

Divergent Opinions in External Articles - The opinions expressed in articles from external sources do not necessarily reflect the views of Renalco SA and are shared for informational purposes only.

This provocative title actually refers to a book that was published 20 years ago by the famous German economist Hans-Werner Sinn, then President of the Ifo Institute for Economic Research. At that time, in the early 2000s, he questioned what happened to the German economic miracle and what could be done to fix it. Such questions resonate heavily today, as Germany prepares itself for snap elections in early 2025. The current coalition collapsed in early November, in a context where Olaf Scholz has been Germany’s least popular chancellor on record and as the economy has stagnated in the past five years.

While the CDU/ CSU is on track to win the federal election according to the latest polls, it would still have to build a coalition, potentially with the SPD (and less likely with the Greens). Despite this complex political arithmetic, there is renewed interest in Germany’s reform momentum and the market implications associated with that. One key unknown is whether the CDU, which put in place strict fiscal rules in 2009 (“the debt brake”), can loosen the grip on public finances and stimulate the economy with higher spending in infrastructure and defence, on top of structural reforms. Germany’s public finances are in much better shape than most of its European neighbours and public investment has lagged behind European peers.

From a market standpoint, a new beginning in Germany would bring relief to the Euro, which has been hammered versus the USD by Trump’s MAGA rhetoric, which is bullish USD. Bond yields also have upside potential, in anticipation of wider deficits. They have started to move upwards in recent weeks, as US treasury yields move higher in anticipation of Trump’s victory and as Scholtz threatened to hold a confidence vote in mid-October.

With regards to European equity markets, German elections would usually be a marginal factor. Typically, the uncertainty and economic gloom in Germany did not prevent the DAX from trading at record highs, with a jump of almost 15% since the beginning of the year, almost twice the performance of the STOXX Europe 600 (+8% in total return). This is mainly due to SAP, up 60% YTD. Also, according to our estimates, DAX companies generate less than 20% of their revenues in Germany. And, we readily acknowledge that, at this juncture, the key drivers of European stocks will likely remain global factors, in particular the policies implemented by the new Trump administration and the Chinese policy response.

Still, in a context where global investors are decisively underweight European stocks (all the more after the Trump trade), there is no doubt that any significant steps that improve the overall European GDP outlook would be welcome, especially for domestic sectors.

Beneath the surface of broad indices, we flag below some sectors and stocks that could benefit from a German reset in 2025, with the help of our German Equity Research Team:

- Defence: Germany is already at 2% of GDP but arsenals are empty. Restocking effort for 4-5 years. Country could even increase spending above 2%. Probably an easier thing to do with debt brake change. Stocks: Rheinmetall, Renk.

- Infrastructure: Easy lever to pull to drive the domestic economy, especially in Germany where we note chronic under investment. Stocks: Heidelberg Materials (about 30% of sales exposure to Western Europe with a chunk in Germany), ACS/Hochtief (low exposure to Germany but a German contracting company).

- Consumer: Restoring confidence is the key, with huge potential pent-up demand after years of an excessive saving rate and real wages improvement. Labour market at the tipping point though. Stocks: Stroer (out of home advertising, 90% exposure to Germany), Douglas (30% of exposure to Germany), Zalando (30% exposure to Germany), TUI (28% exposure to Germany).

- Automobiles: German auto industry needs competitiveness measures: labour flexibility and a better balance between economic and environmental targets. CDU likely to push for easing CO2 targets at EU level. Stock: VW most positively exposed.

- Real estate: CDU is favourable to supply side regulation on residential real estate, hence not in favour of policy that caps rental growth. Stocks: Vonovia, TAG Immobilien.

- Banks: Most exposed to German domestic recovery. Stock: Commerzbank.

- Utilities: Slower transition but still a transition. Exit coal slower, deploy renewables more slowly. Power costs: governments can cut taxes, thereby reducing power costs for consumers and industries. Stocks: positive for RWE.

Week ahead: preliminary PMIs for November will be available in major countries, while the UK and Japan CPI for October will also be released. On the corporate front, NVIDIA will release its quarterly earnings on 20 November.

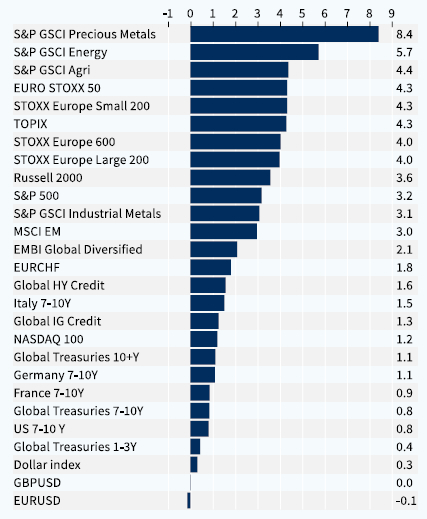

Cross-asset performance (last week, %)

Copyright © 2024 Kepler Cheuvreux. All rights reserved.

This document is produced by Kepler Cheuvreux, an investment firm authorized by the ACPR under number 14441 and regulated by the Autorité des Marchés Financiers, incorporated in France under number RCS 413 064 841 at the following address: 112 Avenue Kleber, 75116 Paris, France (www.keplercheuvreux.com).

This document does not constitute a prospectus/regulatory document or other offering document, nor does it constitute an offer or solicitation to purchase securities or other investments. It should not be construed as an offer to sell or a proposal to buy any securities in any jurisdiction in which such an offer or proposal would be unlawful. We are not soliciting any action on the basis of this document, which is provided to our clients for general information purposes. It does not constitute an investment recommendation or a personalized recommendation, and does not take into account the investment objectives, financial situation and needs of each client. Before acting on the contents of this document, we advise you to check whether it is suitable for your particular situation and, if necessary, to seek professional advice.

The figures relating to past performances refer or relate to past periods and are not a reliable indicator of future results.

The accuracy, completeness or timeliness of information from external sources is not guaranteed, although it was obtained from sources reasonably believed to be reliable. Kepler Cheuvreux assumes no responsibility in this regard.

Information provided in this document concerning market data is retrieved from databases at a precise period of time and is subject to variations.