Back to Reality

998 Monday, 8 January 2024 11:59

Divergent Opinions in External Articles - The opinions expressed in articles from external sources do not necessarily reflect the views of Renalco SA and are shared for informational purposes only.

We wish you all a happy and prosperous year 2024! Have you ever left out a glass of milk for Santa Claus on Christmas Eve with your kids? Naturally, the glass of milk would still be full the next morning if you didn’t drink it on Santa’s behalf, right?

Well, at this time in early January, the markets have likely arrived at a similar conclusion – i.e. that unfortunately Santa Claus doesn’t really exist: December’s gains were borrowed from 2024, just as the gifts at the bottom of the tree did not come for free. But hey, we all enjoyed Christmas, didn’t we?

January 2024 follows one of the best Decembers of the last 30 years – in fact, the fifth-best December of the S&P 500 with a return of 4.4%. November 2023 was also the second-best November of the last 30 years with a return of almost 9%. December saw the rally broadening to cyclicals thanks to Santa Claus, aka Jay Powell.

It is thus unsurprising to see global markets starting 2024 on a weak note – all the more so given that the following items should be added to the above argument:

- According to our ETF team, Q4 2023 saw very strong inflows in the Equity asset class, driven by US equity, making 2023 a pretty decent year for inflows.

- Markets were very significantly “over-bought” according to our technical analyst.

Bulls will point out that there are still record-high amounts of cash sitting in money market funds “waiting to be reinvested”. However, we would counter this with two arguments:

- Our charts from CFTC suggest the “positioning” is actually stretched in the US market.

- The share of stocks in US households’ financial assets is close to an all-time high. The question is rather whether retail investors will reduce their holding of stocks in the coming quarters.

On fundamentals, just like the yoghurt in your fridge doesn’t change much at midnight of its expiry date, not much has changed since our last weekly report from mid-December. All the latest data has been consistent with the soft-landing narrative in the US. The December ISM Services reminds us though that in “soft landing”, there is the word landing.

- However, in the balance of risks, the geopolitical tensions in the Middle East have truly taken a turn for the worse in late December with attacks on Western cargos ships in the Red Sea and a much more confrontational stance from Iran with regard to Israel. Should the conflict widen, it could create oil price disruptions at any moment, threatening the whole “disinflation/soft landing” scenario. We have kept our OW stance on Energy precisely to hedge that risk, but also because oil companies can offer very substantial shareholder returns at current oil levels.

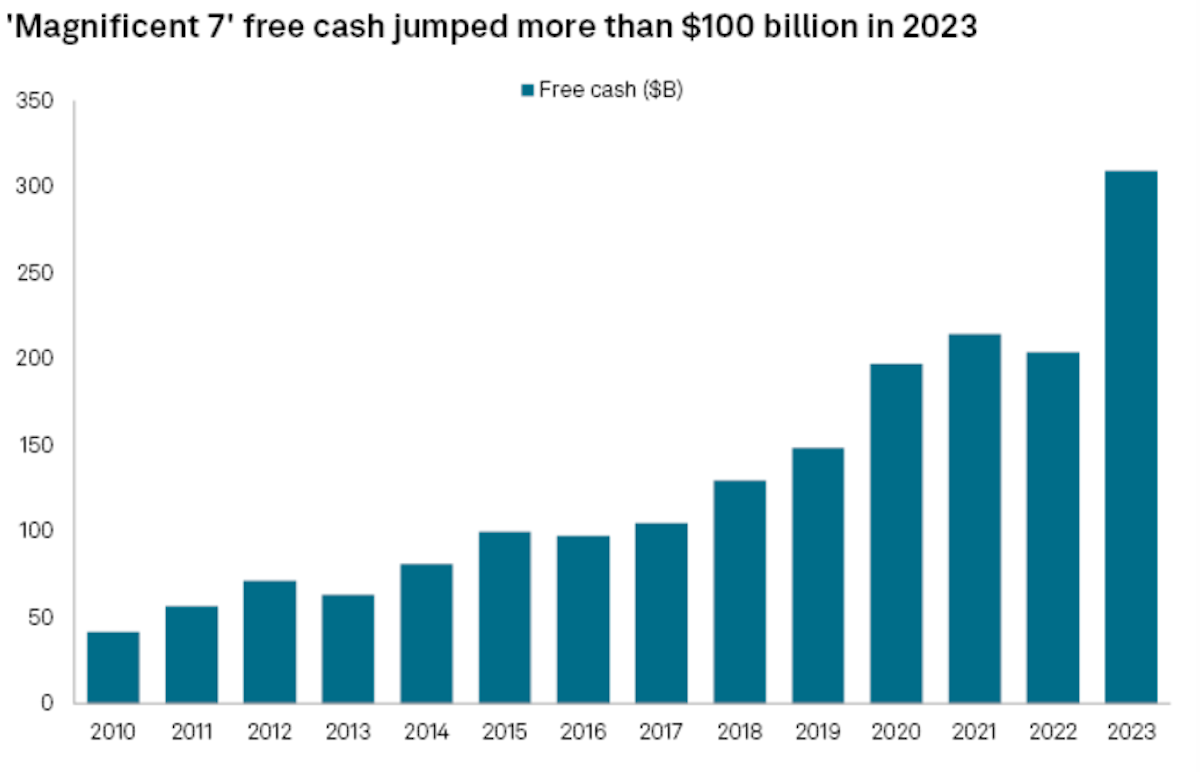

- With more than five cuts (by 25bps) expected for US policy rates in 2024, demanding earnings expectations despite a sharp decline in nominal growth, and the monstruous performance of Big Tech in 2023, equity markets (slight UW) look to us to be ahead of fundamentals.

One note of optimism rather than caution: China released a surprisingly strong PMI Services (the Caixin index is diverging upwards from the China Federation of Logistics and Purchasing PMI that declined) and iron ore prices have been on a rising path (some stocks very much exposed to China have taken notice). While US and European equity markets are surfing at all-time-highs levels, MSCI EM is still some 37% below its 2021 top. That’s one of our key convictions. On China specifically, it’s early days to turn decisively more confident as property woes haven’t been resolved just yet, but we noted several positive policy signals at the end of last year (“pursuing stability through growth”, PBOC’s PSL injection into banks).

Week ahead: The key highlight will be US CPI for December, expected to have increased by 3.3%, from 3.1% in November, as energy base effects gradually fade. Core CPI is expected at 3.8%, from 4% in November. Still in the US, the NFIB small business optimism survey will be particularly relevant after the December rally in US small caps. In Europe, industrial production figures for November are unlikely to have many market implications, as they lag. In Japan, the Tokyo CPI, a proxy for national inflation, will be important ahead of the 23/01 BoJ meeting, which could end the negative rates era in Japan. In China, watch trade figures for December, as well as the CPI/ PPI and credit growth. Taiwan presidential elections will take place on 13 January. The earnings season will start, with major US banks reporting earnings towards the end of the week.

Asset classes performance (2023)

Copyright © 2024 Kepler Cheuvreux. All rights reserved.

This document is produced by Kepler Cheuvreux, an investment firm authorized by the ACPR under number 14441 and regulated by the Autorité des Marchés Financiers, incorporated in France under number RCS 413 064 841 at the following address: 112 Avenue Kleber, 75116 Paris, France (www.keplercheuvreux.com).

This document does not constitute a prospectus/regulatory document or other offering document, nor does it constitute an offer or solicitation to purchase securities or other investments. It should not be construed as an offer to sell or a proposal to buy any securities in any jurisdiction in which such an offer or proposal would be unlawful. We are not soliciting any action on the basis of this document, which is provided to our clients for general information purposes. It does not constitute an investment recommendation or a personalized recommendation, and does not take into account the investment objectives, financial situation and needs of each client. Before acting on the contents of this document, we advise you to check whether it is suitable for your particular situation and, if necessary, to seek professional advice.

The figures relating to past performances refer or relate to past periods and are not a reliable indicator of future results.

The accuracy, completeness or timeliness of information from external sources is not guaranteed, although it was obtained from sources reasonably believed to be reliable. Kepler Cheuvreux assumes no responsibility in this regard.

Information provided in this document concerning market data is retrieved from databases at a precise period of time and is subject to variations.