The beginning of a trend?

Monday, 20 May 2024 23:12

Divergent Opinions in External Articles - The opinions expressed in articles from external sources do not necessarily reflect the views of Renalco SA and are shared for informational purposes only.

Calling turning points in macro data is always a tricky exercise. These points become apparent with a lag, which adds little value for the purpose of investing, as markets are constantly looking ahead, not backwards.

But as the first data for the current quarter are being made available, some signs of a slowdown are appearing in the US, which we discuss in this report. Job creation, consumer confidence, and retail sales were all a tad weaker than expected in April. On top of the easing of geopolitical tensions, which has dragged oil prices lower since late April, this has contributed to lowering yields somewhat across maturities and currencies.

A slowdown in US domestic demand would be consistent with the gradual disappearance of the buffers which supported the resilience seen over the past couple of years: excess savings accumulated during the pandemic are now depleted, savings rates now stand near record lows, and consumer credit is expensive. Rising delinquencies in credit cards and auto loans also call for some moderation in consumer spending. Hence, after the massive growth surprises of recent quarters, a slowdown in the US would be the beginning of a trend with strong implications across asset classes globally.

Easing concerns about inflation/interest rates would be highly supportive for fixed income after the renewed challenges faced by the asset class since the beginning of 2024. We have started to position ourselves to take advantage of the “duration” risk premium, switching from high yield to investment grade credit a couple of months ago both in Europe and in the US. In the former, there is some evidence of a desynchronisation relative to the US. Growth in the euro area was weak in recent quarters, when the US was booming. And there are now signs of a cyclical upswing in Europe as the US is decelerating. Yet, in financial markets, the US dictates the trend. This implies that if bond yields soften in the US, they will soften in Europe as well, irrespective of the growth conditions.

In European equities, lower bond yields would have major implications. The main beneficiaries would be small caps as well as bond proxy sectors, which are by definition sensitive to bond yields, such as MedTech (OW) and Renewables in utilities. And then, obviously, real estate (OW), which we discuss in more detail this week.

The European Real Estate equity sector (+3.5% YTD vs. +9.2% for the broader MSCI Europe as of 16 May) has been penalised by sticky US inflation that has kept bond yields high. According to fund managers’ surveys, the Real Estate equity sector remains the most underweighted in Europe and globally. So, it would not take a lot to propel the sector higher and repeat the short squeeze of H2 last year, when bond yields peaked on hopes that the world’s central banks would soon begin cutting interest rates. The discount to net tangible assets reflected in current equity prices remains high at 28%. This discount would imply an 18% drop in the valuation of underlying real estate assets, given the leverage in the sector. Our preferred segment is logistics (benefitting from secular growth trends) and German residential (one of the most defensive segments). Most preferred stocks: Balder, LEG Immobilien, Unibail-Rodamco-Westfield, VGP, Vonovia. Least preferred stocks: Atrium Ljungberg, CA Immobilien, Immofinanz.

Week ahead: The minutes from the 1 May FOMC meeting and frequent communication from Federal Reserve officials next week could introduce some noise, as it is far too early for the Fed to acknowledge any turning point. Apart from that, the macro newsflow will be relatively light and the earnings season is coming to an end in Europe as well. Preliminary May PMIs will be available for major economies.

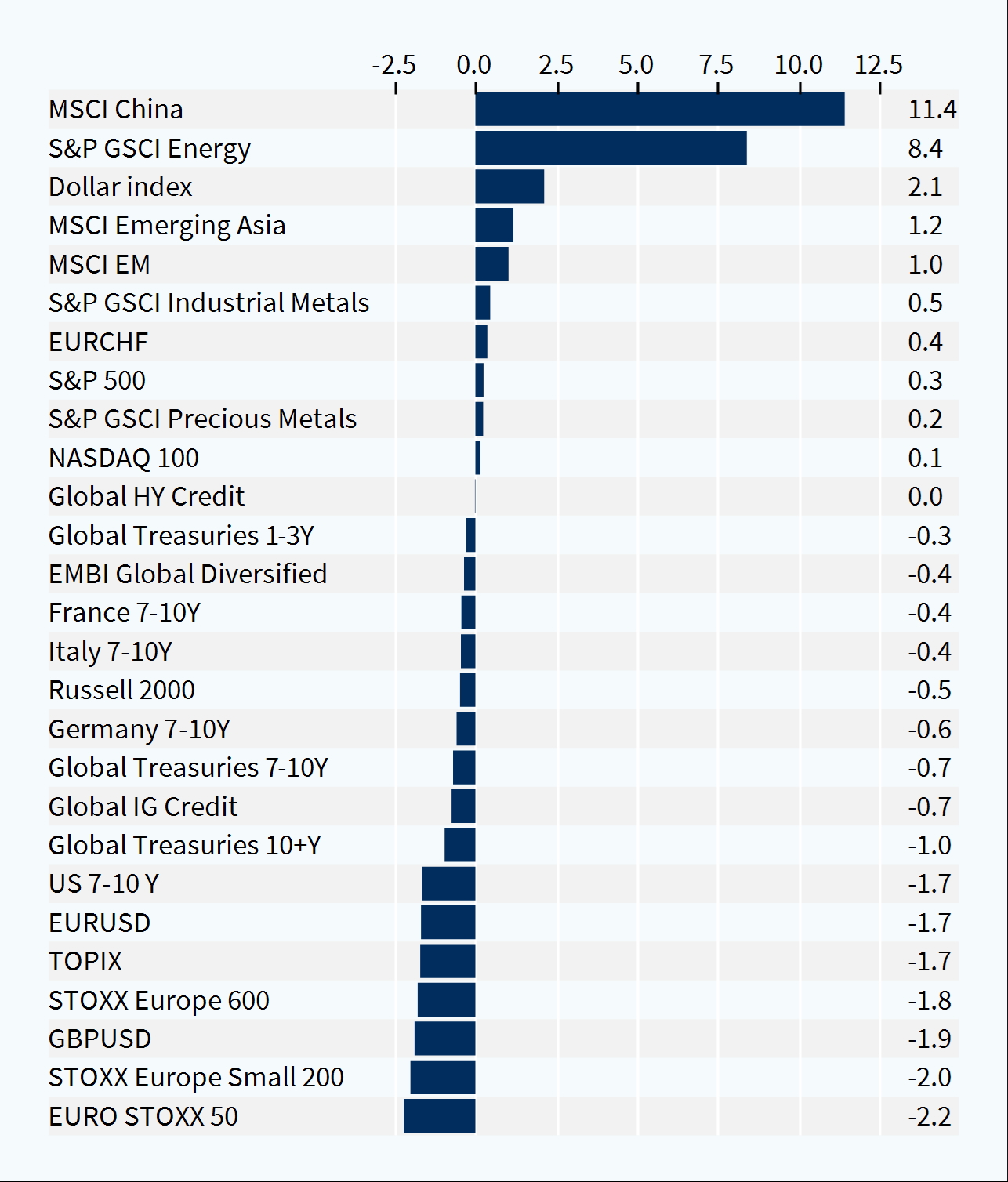

Asset classes performance - weekly (%)

Copyright © 2024 Kepler Cheuvreux. All rights reserved.

This document is produced by Kepler Cheuvreux, an investment firm authorized by the ACPR under number 14441 and regulated by the Autorité des Marchés Financiers, incorporated in France under number RCS 413 064 841 at the following address: 112 Avenue Kleber, 75116 Paris, France (www.keplercheuvreux.com).

This document does not constitute a prospectus/regulatory document or other offering document, nor does it constitute an offer or solicitation to purchase securities or other investments. It should not be construed as an offer to sell or a proposal to buy any securities in any jurisdiction in which such an offer or proposal would be unlawful. We are not soliciting any action on the basis of this document, which is provided to our clients for general information purposes. It does not constitute an investment recommendation or a personalized recommendation, and does not take into account the investment objectives, financial situation and needs of each client. Before acting on the contents of this document, we advise you to check whether it is suitable for your particular situation and, if necessary, to seek professional advice.

The figures relating to past performances refer or relate to past periods and are not a reliable indicator of future results.

The accuracy, completeness or timeliness of information from external sources is not guaranteed, although it was obtained from sources reasonably believed to be reliable. Kepler Cheuvreux assumes no responsibility in this regard.

Information provided in this document concerning market data is retrieved from databases at a precise period of time and is subject to variations.